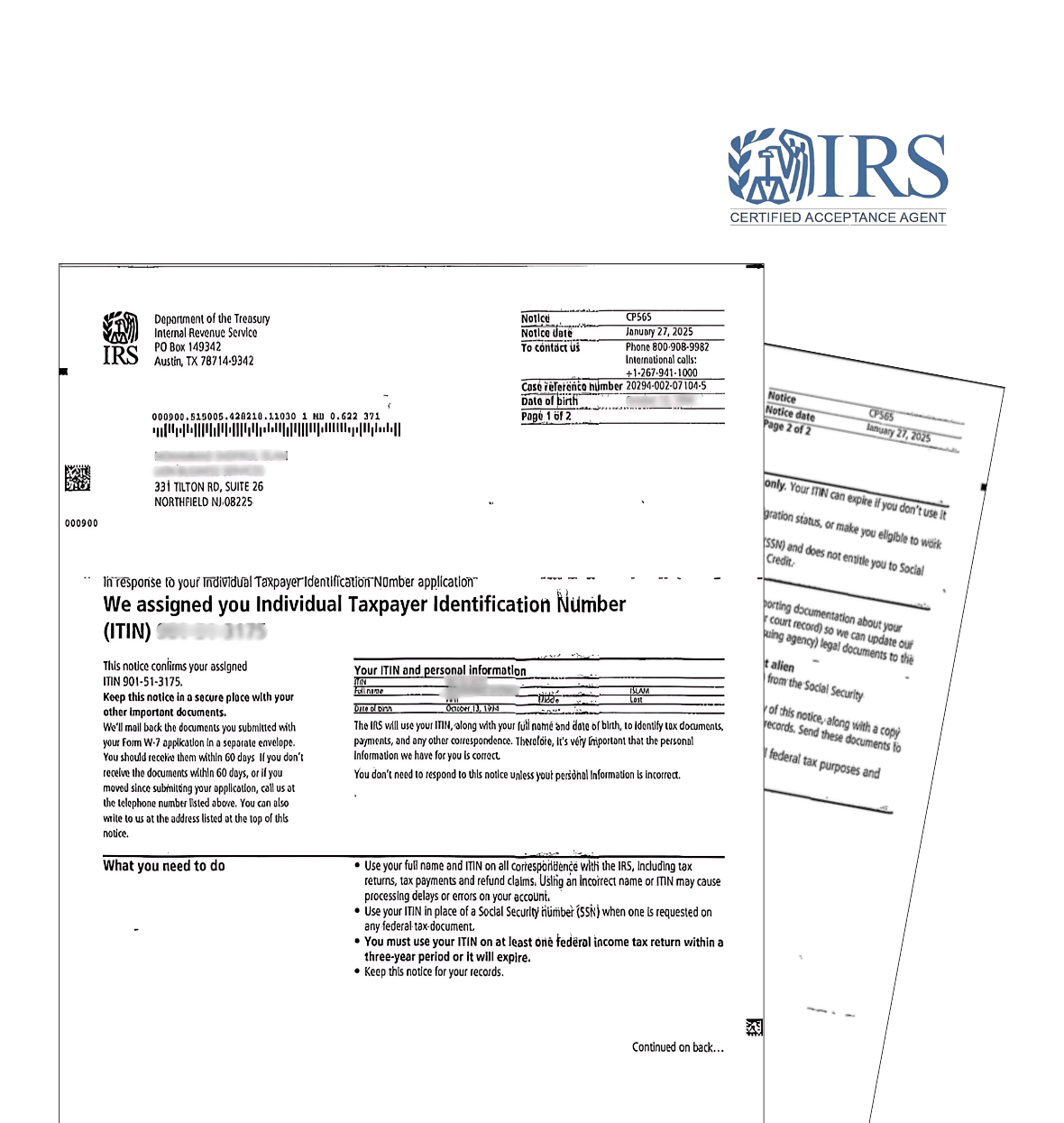

Apply for Your ITIN in Just a Few steps!

Over 300+ Entrepreneurs served globally

Why Do You Need an ITIN?

- File US tax returns as a non-resident individual.

- Open US bank accounts that require a taxpayer ID

- Comply with IRS tax regulations for global income

- Claim tax treaty benefits.

- Start building US credit history without an SSN.

- Add ITIN dependents to maximize tax filing benefits.

- Support your US business formation and operations.

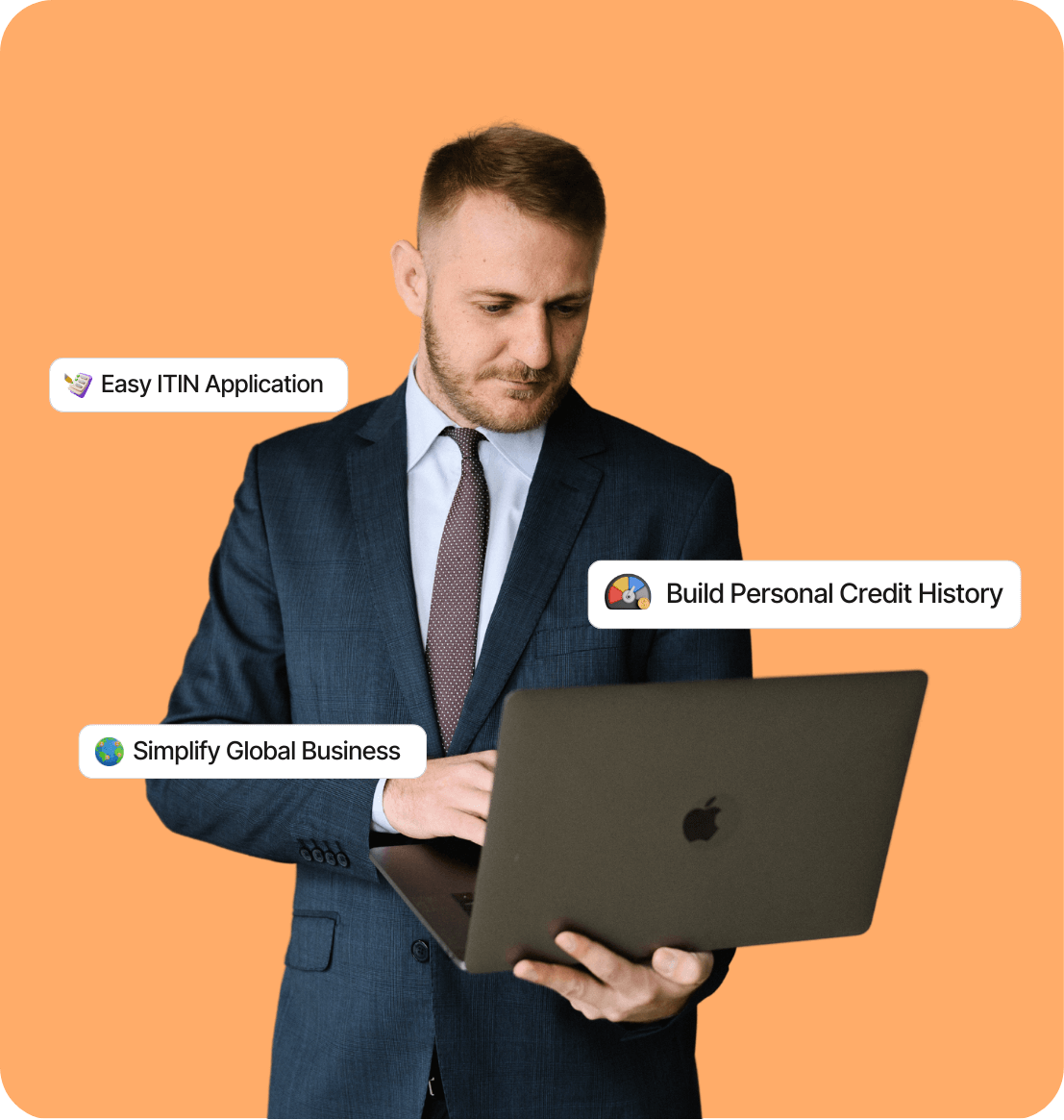

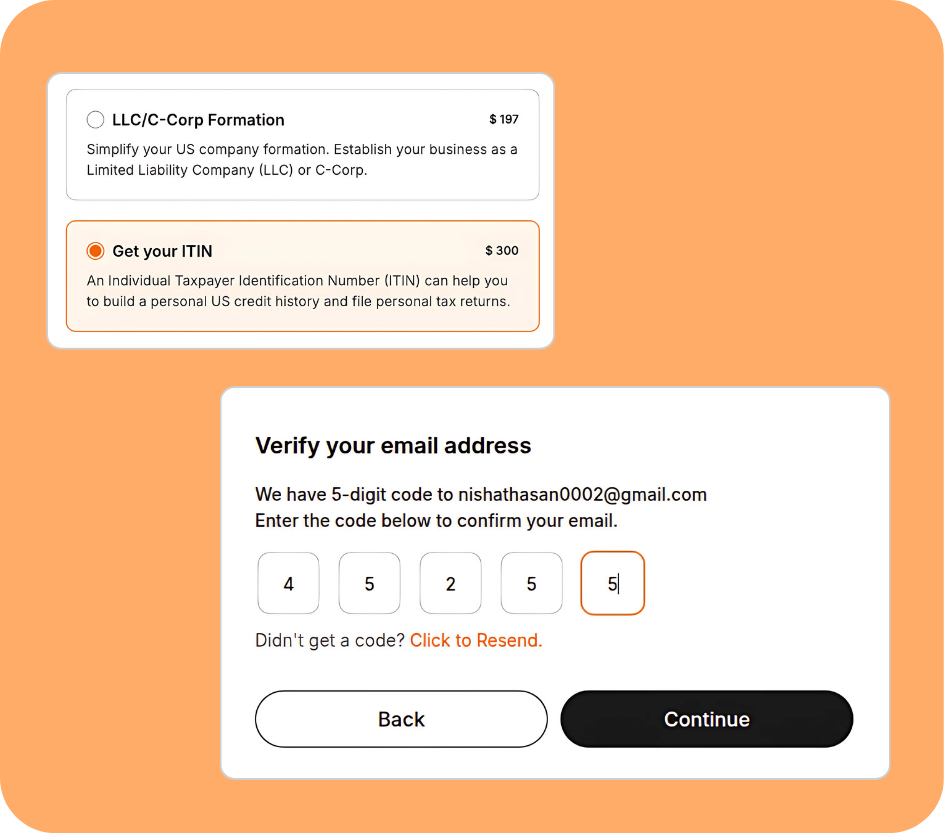

Our Easy 3-Step Process

Verify Your Email

Choose the “Get Your ITIN” package and click Continue. Enter your email and verify it using the OTP sent to your inbox.

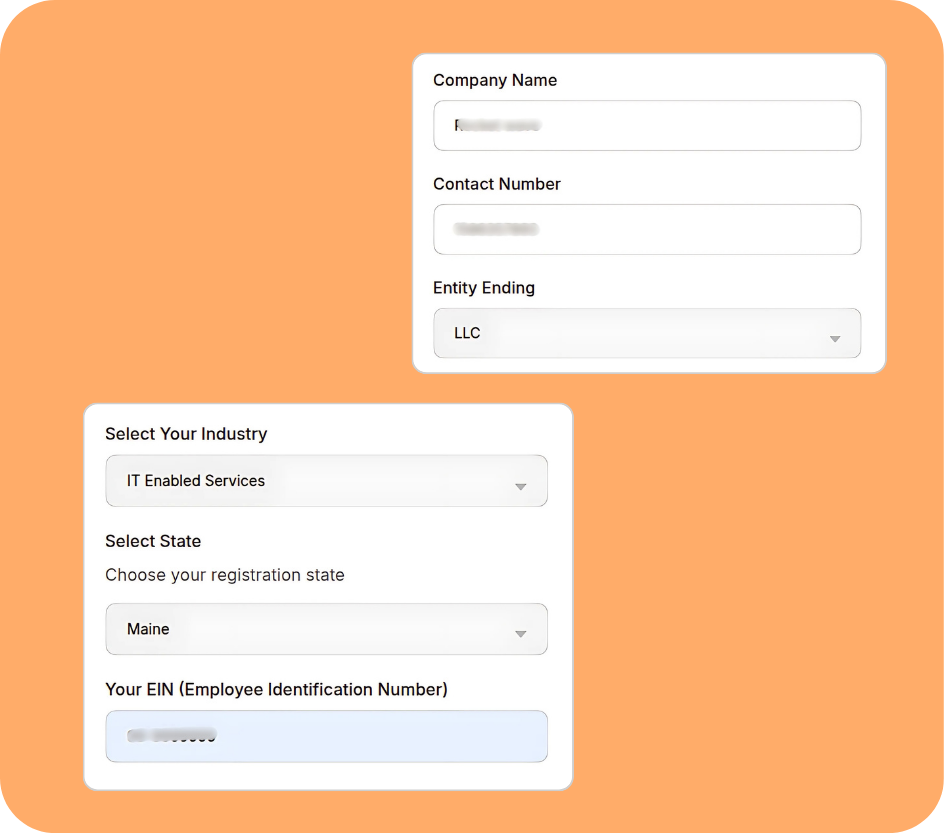

Complete Your Information

Provide your personal and business details, select your U.S. state, and submit your EIN to proceed.

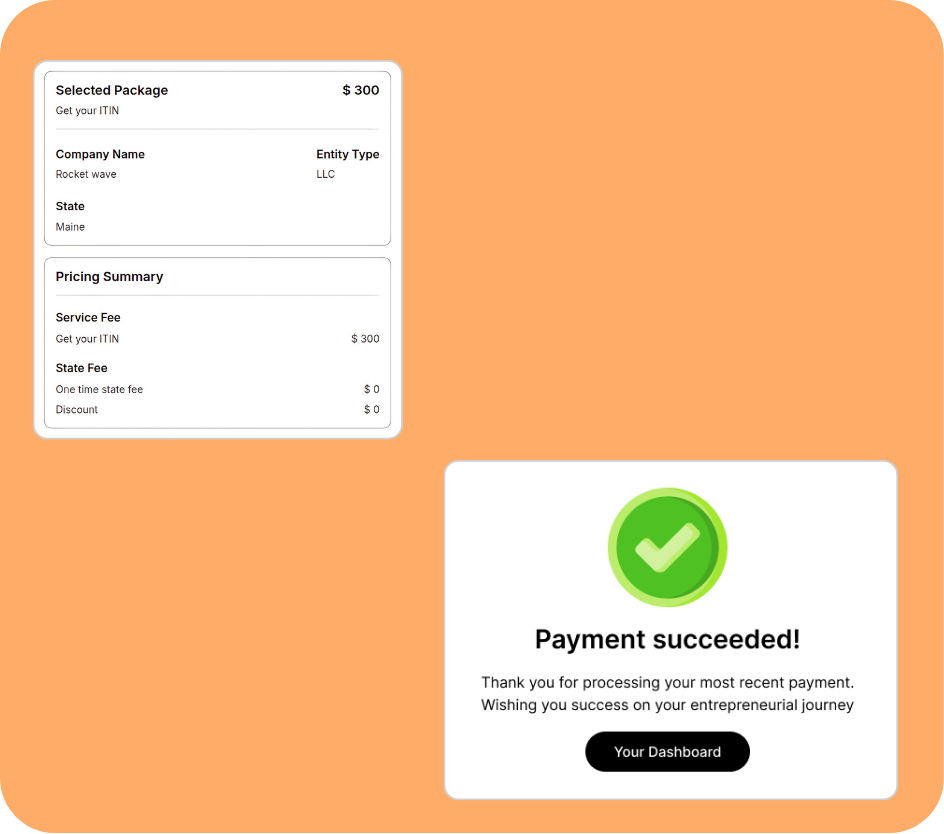

Confirm & Get Started

Make the payment to confirm your order. We’ll begin processing your ITIN, and you’ll receive the official confirmation letter directly in your dashboard.

Our ITIN Package

- Full IRS-compliant ITIN application preparation

- Documentation review and support

- IRS correspondence handled on your behalf

- Faster and expert processing

- Lifetime support & guidance

- Easy Dashboard Access

Over 300+ Entrepreneurs served globally

Fast and Hassle-Free Process!

“Rocket Wave made getting my ITIN incredibly easy. The support team guided me through each step and delivered everything on time. Highly recommend!”

— Chroma Capital

Perfect for Non-U.S. Entrepreneurs

“As someone running a U.S. business from Bangladesh, I needed an ITIN to access Stripe. These guys handled everything professionally and quickly.”

— Breacher Development

Exceptional Support & Service

“From email verification to receiving my ITIN letter, everything went smoothly. The team was responsive and knowledgeable throughout the process.”

— PLANATE X

Frequently Asked Questions

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS) in the United States. Learn more about ITIN and why it’s important.

Individuals who need to file a U.S. tax return but are not eligible for a Social Security number (SSN).

- U.S. citizens

- Nonresident aliens with visas permitting them to work in the U.S. (qualify for an SSN)

- Permanent legal resident of the U.S. (Green card holder, also known as Permanent Resident Card)

- Any individual who is eligible for or has a valid SSN

- Applicant not meeting the criteria for residency and ID documentation (who failed to prove identity and foreign status)

To get ITIN with Rocket Wave all you need to provide is your Basic Personal Information (i.e., Legal name, address, etc.), a Government-issued valid Passport, and details of your US Registered Company (LLC/ C-Corp).

Processing times can vary but typically take several weeks.

Yes, ITINs not used on a tax return for three consecutive years expire. You can renew an expired ITIN by filing a new application through Rocket Wave.

You can request a replacement ITIN document by filing Form W-7 again with a copy of your identification documents. However, if you secure your ITIN through Rocket Wave it will always remain on your dashboard and you’ll never lose any important documents.

Yes, you can notify the IRS of any changes to your name or address by filing Form 8822, “Change of Address.” Please reach out to our customer support team for such changes.