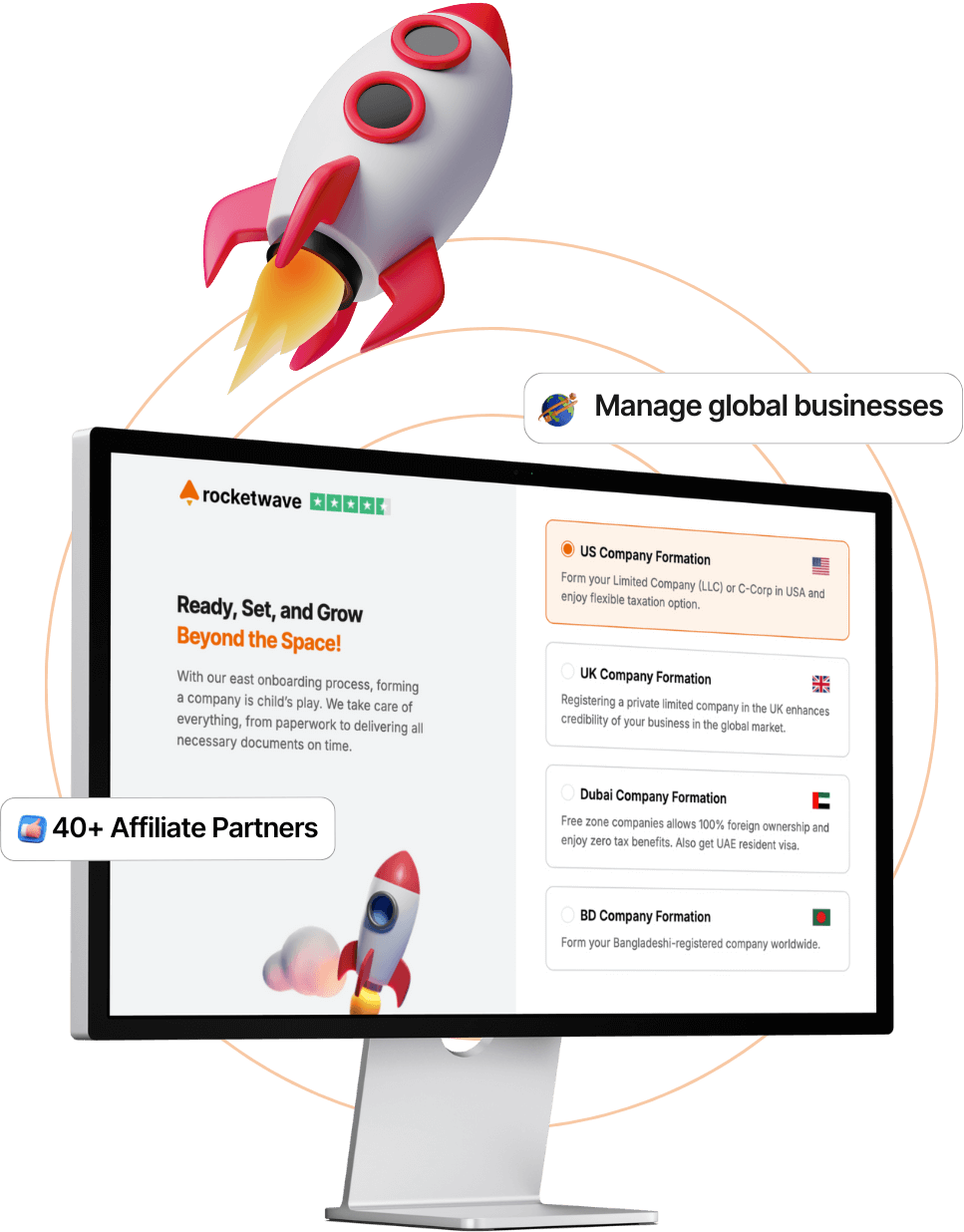

Expand your business globally in 2026 🌍

Form your US Company (LLC or C-Corp) easily from Bangladesh.Receive your EIN (Business Tax ID), and set up your Business Bank Account and payment gateways like PayPal, Stripe, Relay, and more.

Why Form a US LLC or C-Corp? 🔥

Enjoy pass-through taxation and limited liability protection

Open legal Business PayPal and Stripe accounts

Apply for US business bank accounts like Airwallex, Relay etc.

Apply for a US bank credit card or loan using ITIN

Attract global investors and raise funding

How Rocket Wave Helps You with US LLC Formation

Company Formation

Form your LLC in Wyoming, Florida, Texas, Delaware, or any other state. Based on your business requirements, we help you choose the right structure, either LLC or C-Corp.

Get Your EIN

Employer Identification Number is your US business tax ID. You need it to operate your business and handle tax matters.We secure your EIN from the IRS within 2 to 3 weeks* after company formation.

Bank Account and Payment Solution Assistance

Our support team assists you with preferred bank account applications and payment solution setup. To receive this support, you will need to purchase our Financial Tool Service Package.

Over 450+ Bangladeshi founders trust Rocket Wave.

Why wait? Form your US LLC today.

Take a quick look at our US LLC Formation package.

Package Price: $197 Service Fee + State Fee

- LLC formation in any US state

- Filing of Articles of Organization

- BOI Report filing

- EIN setup

- One year registered agent service

- Operating agreement

- Stock issuance

- Lifetime compliance alerts

- Easy user dashboard

- Dedicated customer support

- 7-Days Money Back Guarantee* (* No hidden or extra charges)

Check Our Refund Policy

Add-On Services:

- Bank account setup assistance

- Payment solution assistance

- Obtain Unique Address

- ITIN (Individual Tax Payer Identification Number)

- Sales tax license

- Reseller certificate

Fill out the form below to get started. 👇

Grow your business globally with your own US LLC!

Still confused? 🤔 Check the frequently asked questions below

or book a Free Consultation with our expert team.

Do I need to be a US citizen to form a US LLC?

What is the difference between a UK company and a US company?

What is the benefit of forming a US LLC for Amazon sellers?

What is a Registered Agent?

Will I get a US address for my company?

What documents do I need to form a US company?

- Your contact details (Name, Email, Phone, Address)

- A name for your US company

- A scanned copy of your passport

Is it safe to open PayPal or Stripe using a US LLC?

Do you guarantee PayPal or Stripe accounts?

Can I open a US bank account?

Do I need to pay extra for a Registered Agent?

US LLC Form করতে প্রয়োজনীয় তথ্য দিয়ে নিচের ফর্মটি পূরণ করুন 👇