With our easy onboarding process, forming a company is child’s play.

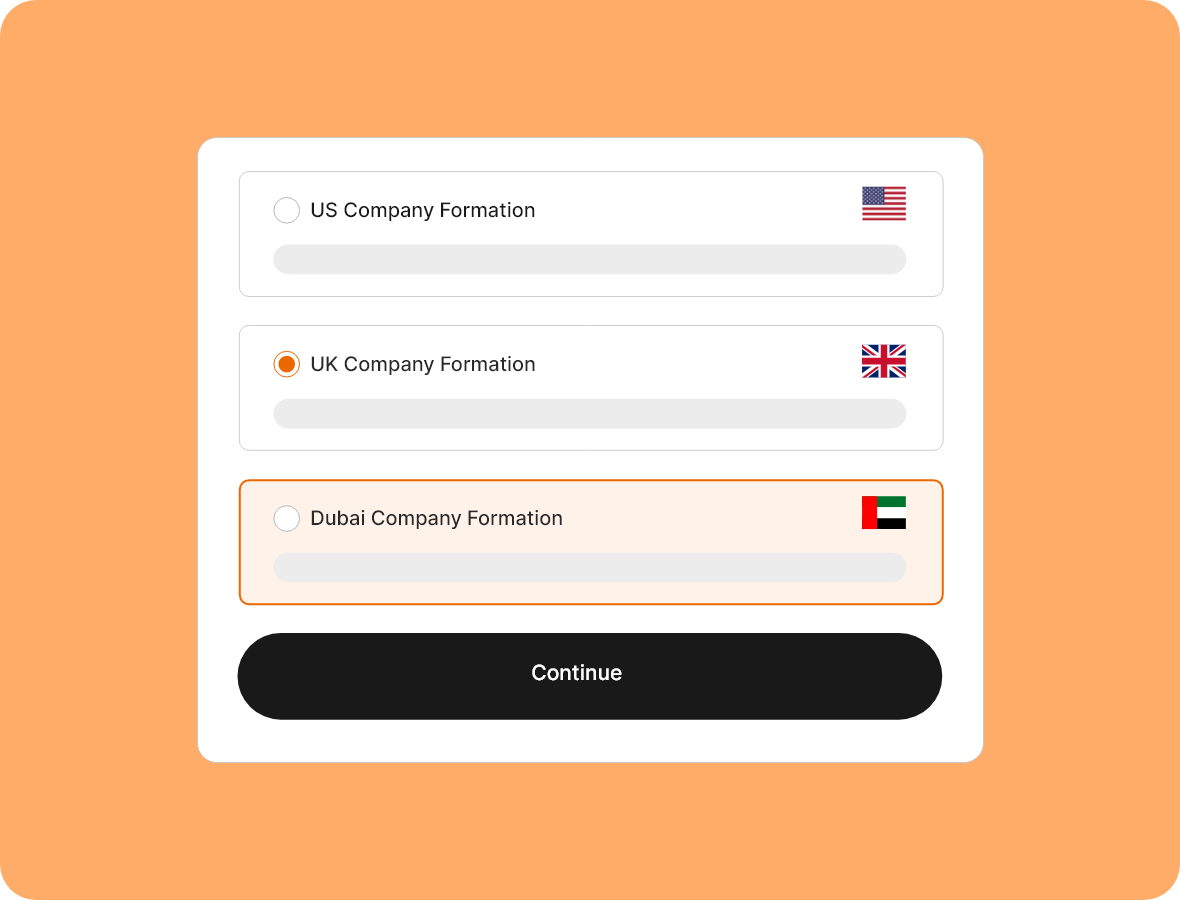

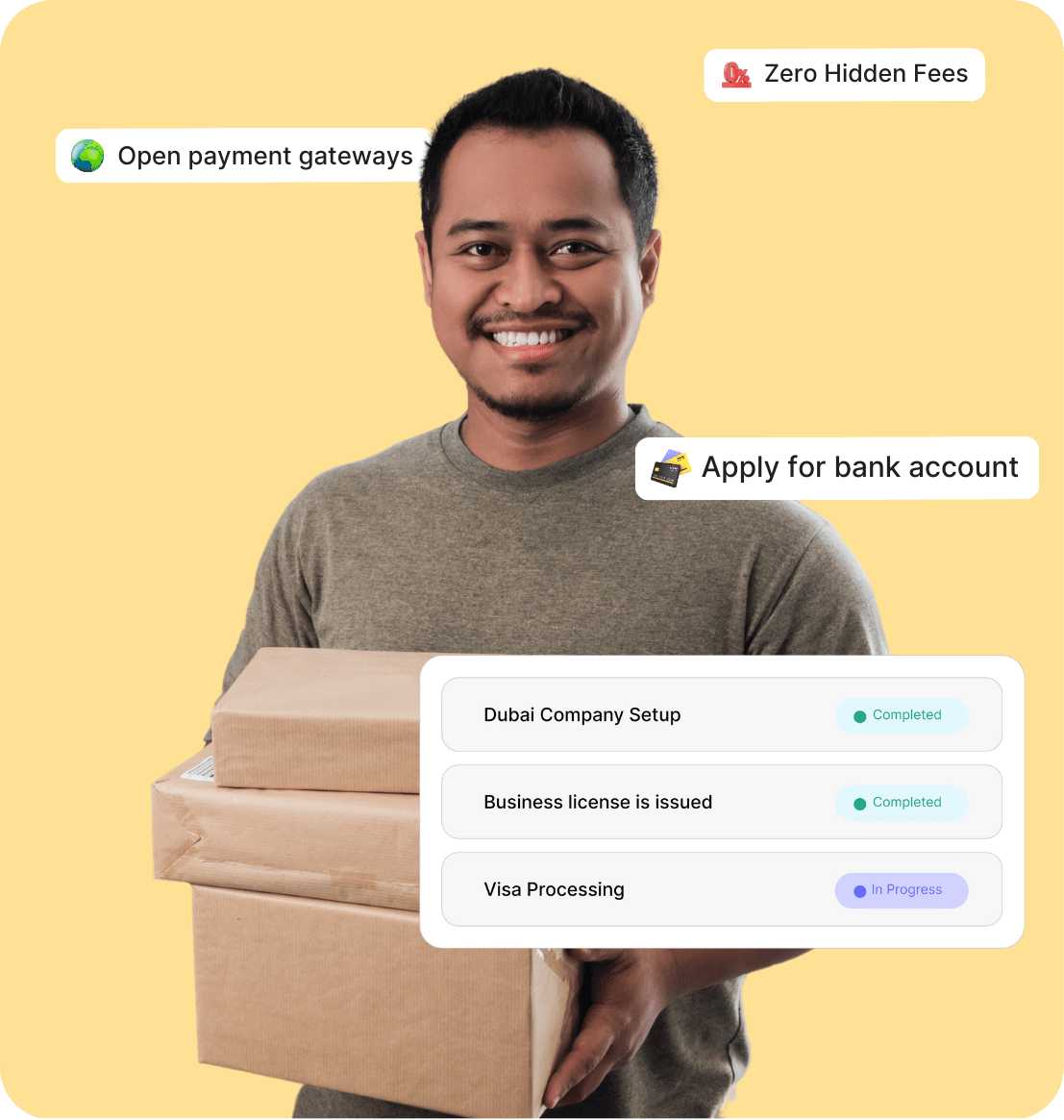

Start by choosing where you want to establish your business—whether it’s in the US, UK, or Dubai.

Give a suitable business name and enter business details. Once you’ve reviewed everything, you’re ready to launch your global company!

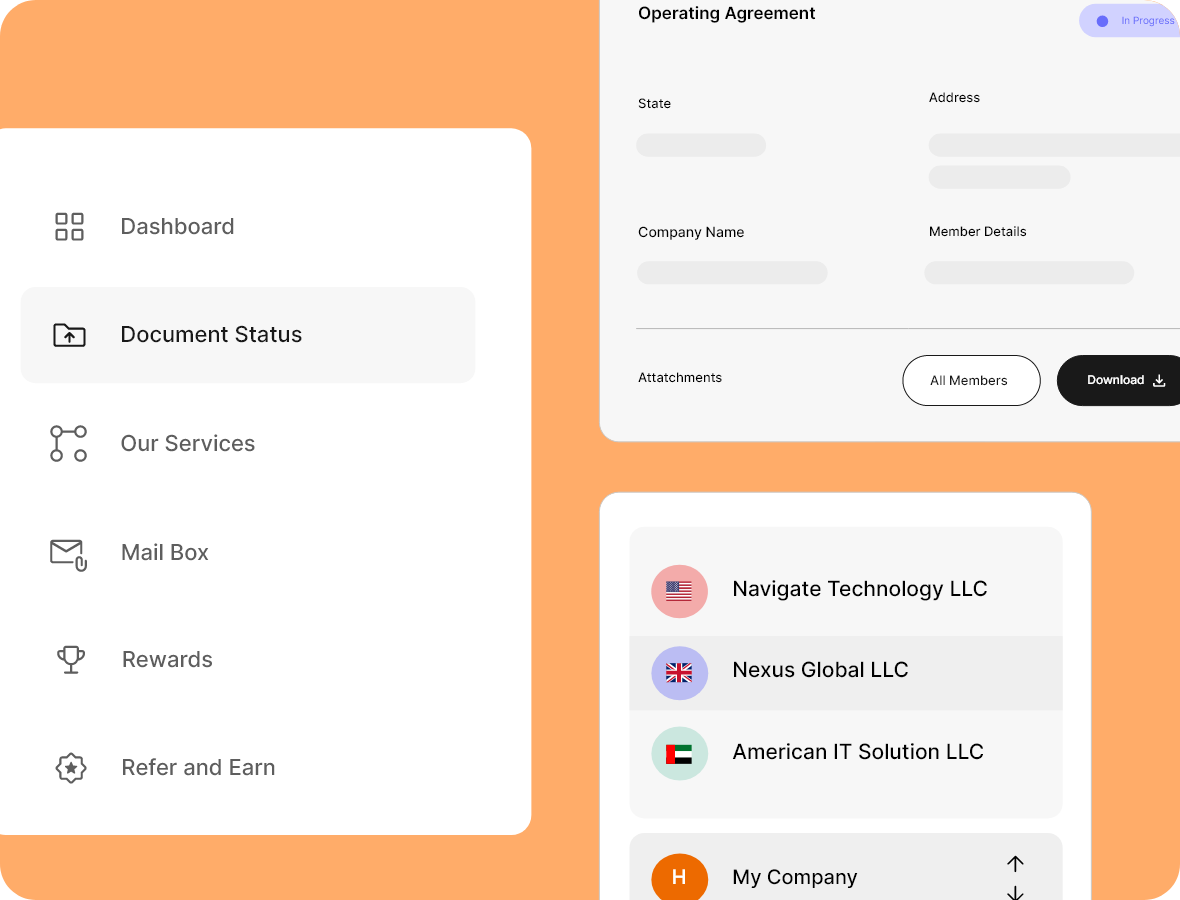

Easily manage all of your business documents and correspondence. Get notifications and maintain total compliance.

With so many options out there, we set ourselves apart by focusing on two key principles: simplicity and transparency

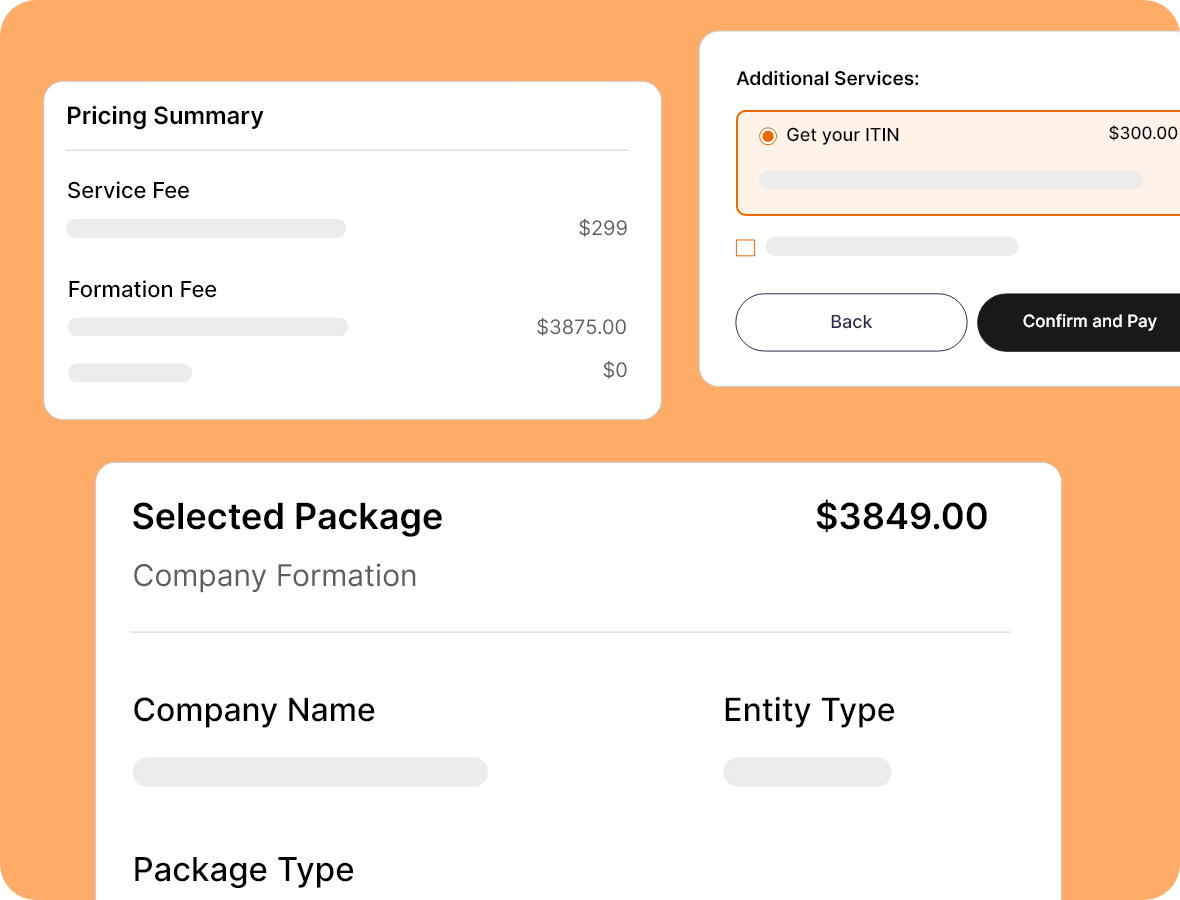

Our simple pricing lets you launch your business without stress about hidden costs.

We manage the entire compliance of your business with all regulations and laws, ensuring trust and credibility.

Every business is different. Our 1-on-1 consulting provides tailored solutions based on your requirements.

Starts from $197+State Fees

Check Our Refund Policy

Starts from $229

Starts from $3849

We ensure your idea takes off smoothly and reaches new heights!

Establish your business in the major markets like US, UK, or Dubai with Rocket Wave.

We are here to help with payment & banking solutions, operations,and consultancy.

We cover annual filings, tax requirements, legal support, and dissolution.

Our Commitment to You

Rewards and Resources

We partner with amazing companies to offer exclusive rewards. You’ll feel like an elite member in no time!

From Launch to Grow

Don’t wait any longer. Join the hundreds of entrepreneurs who have already launched their businesses globally with Rocket Wave.