Choosing the appropriate business structure is one of the first steps in starting a company in the US or the UK. To make an informed choice, international business owners must comprehend the distinctions between a US Limited Liability Company (LLC) and a UK Limited Company (LTD). The main distinctions and formation procedures will be covered in this article, which will also assist you in choosing the best business structure for your needs as an entrepreneur.

What is a UK LTD and a US LLC?

UK LTD (Limited Company)

A private limited company, or UK LTD, is a typical business form in the UK. It guarantees that shareholders’ assets are safeguarded in the event of business debt by offering limited liability protection. A UK LTD is legally autonomous from its directors and stockholders since it is a distinct legal entity.

Key Features of a UK LTD:

- Provides limited liability protection to shareholders.

- A separate legal entity, making it responsible for its finances.

- Requires a UK-registered office and at least one director.

- Ideal for entrepreneurs seeking to establish a presence in the UK.

UK LTD Formation Process – Step by Step

- Choose a Company Name: Verify that the name is original and complies with Companies House guidelines. Steer clear of sensitive or restricted language that might need additional authorization.

- Register a UK Office Address: Official correspondence will be sent to this address and made public. A physical address in the UK is required.

- Appoint Directors and Shareholders: Having at least one director who will be legally accountable for the business is necessary. The corporation is owned by its shareholders, who may also be the director.

- Determine Share Structure and Allocate Shares: Choose the quantity and value of shares. Indicate which stockholders will own what percentage of the company’s shares.

- Prepare Memorandum and Articles of Association: The articles of association and memorandum attest to the company’s formation and outline the management guidelines and corporate rules.

- Define Persons with Significant Control (PSC): Determine who has more than 25% of the shares or the ability to vote. Provide PSC information to guarantee openness.

- Choose a SIC Code: This classification code represents your business operations. If the company engages in various activities, several codes can be chosen.

- Register with Companies House: File the formation application online with Companies House for quick processing. Pay the registration fee to complete the process.

- Register for Corporation Tax with HMRC: Required within three months of starting operations. Use your company’s Unique Taxpayer Reference (UTR) to complete the registration.

- Open a Business Bank Account: Keep personal and business finances separate with a business bank account. Provide incorporation documents and ID to the bank.

Want to skip these long steps? Contact us for your UK LTD setup without any hassle.

US LLC Formation Process – Step-by-Step

- Choose a Business Name: Ensure the LLC name is unique in the state of formation. Verify availability through the state’s business registry. For tips, read our article on finding the perfect name for your business

- Designate a Registered Agent: The registered agent accepts legal documents on behalf of the LLC and must be located in the state of formation.

- File Articles of Organization: Submit this foundational document to the Secretary of State or similar state agency. Information required typically includes the LLC’s name, address, and purpose.

- Create an Operating Agreement outlining the LLC’s management structure, roles, and ownership. Although not always legally required, it’s essential for multi-member LLCs.

- Obtain an EIN (Employer Identification Number): Required for tax purposes and to open a business bank account. Apply directly through the IRS.

- File for State-Specific Permits and Licenses: Research and obtain necessary licenses based on business type and state requirements. Ensure full compliance with local regulations.

- Annual Compliance and Reporting: Most states require annual reports and fees. Ensure compliance to maintain active status.

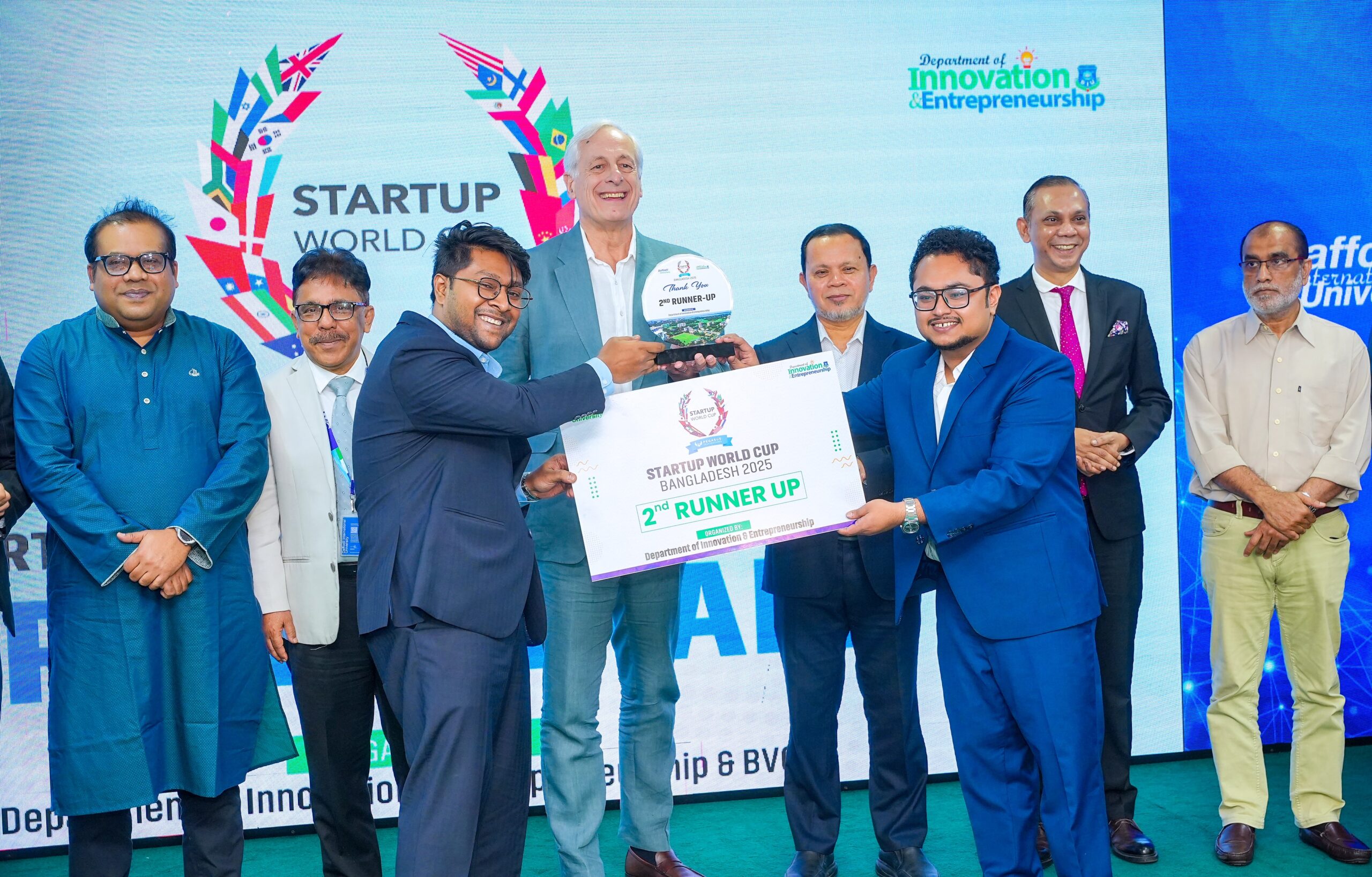

With Rocket Wave, you can save time and simplify your US LLC formation. Get started now to unlock global business opportunities!

Key Comparison between UK LTD and US LLC

| Feature | UK LTD | US LLC |

| Legal Structure | Separate legal entity | Separate legal entity |

| Time to Form | Generally takes 1-3 days with online registration | Varies by state; typically 2-3 weeks, or expedited service available |

| Regulatory Compliance | Annual filing of accounts and confirmation statements with Companies House | Annual reports and compliance vary by state; requirements depend on the state of formation |

| Residency Requirement | No residency requirement for directors, but the registered office must be in the UK | No residency requirement for members or managers |

| Liability Protection | Limited liability for shareholders | Limited liability for members |

| Taxation | Corporation tax (may reduce dividends) | Pass-through (members are taxed on an individual basis) |

| Public Disclosure | Required for directors and shareholders | Limited public information |

| Flexibility in Management | Directors act on behalf of shareholders | Member-managed or manager-managed |

| Ideal for | UK-based business, corporate structure | US-based business, flexible and adaptable for global needs |

Which Business Structure to Choose for a Global Entrepreneur?

As a global entrepreneur, choosing a UK LTD and a US LLC depends on several factors, including your primary market, tax preferences, and management flexibility. Here are some key considerations:

- Geographic Focus: If you plan to operate primarily in the UK, a UK LTD may be beneficial as it aligns with UK laws and tax structures. A US LLC is more suitable for businesses looking to enter the US market.

- Tax Preferences: A US LLC’s pass-through taxation might be favorable if you want to avoid corporate tax and prefer income to be taxed individually. On the other hand, a UK LTD provides certain tax efficiencies within the UK.

- Privacy Concerns: US LLCs offer limited public disclosure requirements, which may be beneficial if privacy is a priority. UK LTDs, however, require public disclosure of directors and shareholders.

- Flexibility: A US LLC is more flexible in structure, allowing you to select member-managed or manager-managed options. UK LTDs, while structured, are less flexible in management.

How Rocket Wave Can Help You Decide

Choosing the right business structure can be complex, especially for global entrepreneurs seeking to expand their businesses across borders. Rocket Wave offers tailored services that guide entrepreneurs through the process of UK LTD Formation and US LLC Formation. We help by:

- Expert Consultation: Providing insights into the pros and cons of each structure and determining the best fit based on your business goals and market needs.

- Complete Formation Services: Simplifying the process of filing, document preparation, and necessary registrations to expedite your business setup. Manage all of your important documents using our simple and easy-to-access platform.

- Compliance Assistance: Guiding you through the required documents, registered offices, and registered agents to ensure full compliance with UK and US regulations.

- Ongoing Support: Offering tax compliance, operational guidance, and management structure advice, helping you scale effectively in your chosen market.

Rocket Wave is here to empower entrepreneurs to make the correct decisions on US LLC Formation and UK LTD Formation, ensuring a smooth business setup and compliance across borders.