Texas has an amazing business-friendly environment to offer for small businesses. It’s a state where more than a million SMEs are thriving. Texas also lets you reach out to regional, national, and global trading hubs with ease. Hence, it’s a good choice for forming your LLC.

If you’re wondering how to get started, you’re at the right place. In this article, we’ll be discussing all the nitty-gritty details of forming LLC in Texas. So, let’s get started!

Steps to Forming LLC in Texas

We’ll share the steps of forming an LLC in Texas sequentially. So, make sure you go through them one at a time.

Step 1: Reserve a Name for Your Texas LLC

The very first step you need to do for forming an LLC in Texas is reserving a name for your company. This step is one of the most crucial ones as it’ll directly affect the performance of your business. Unless you choose a suitable name, your business may underperform.

However, there’s more to it than just that. You can’t choose a name that’s already being used by other companies. Getting a good name that’s not being used can be tough in Texas, as there are millions of other businesses.

Note that you can still use a name that’s under use, but you’ll need permission from the company that’s using it. It is unlikely that you’ll get the permission.

There are two ways of checking if the name of your choice is available or not. You can either check with the Controller of Public Accounts’ Record, or you can contact the Texas Secretary of State via email or a phone call.

The search engine lets you search with the EIN number, Tax ID, or entity name. You need to search with the entity name only.

Let’s say that you’ve found that the name of your choice is up for take. That’s great, but what if you want to take some more time before registering?

In this case, you can file a Texas Business Name Reservation. Doing so will reserve the business name for 120 days, and you need to spend a small amount of $40 for making the reservation. You can renew this reservation for as long as you want, making it a flexible choice.

When choosing the name, you need to ensure a few things. To comply with the Texas State law, your business needs to include one of the following names:

- Limited Liability Company

- L.L.C

- LLC

- Ltd. Co.

- Limited Liability Co.

- Limited Company

As you can see, the company name must contain at least some variant of “Limited” and “Company”. Note that if a variant of either of these words is absent in the name, the name won’t be accepted.

Some other important rules are as follows:

- The name must be original. As in, you can’t use a name that’s being used worldwide or is popular in some other country.

- You can’t pick a name that’s offensive or one that misleads the people into thinking that the business is a government entity.

- There are some restricted or trademarked words that you can’t use unless you have the permission to do so. For example, “Bank”, “Trust Company”, “Olympic”, “University”, “College”, etc.

There are some additional rules as well. Check this document from the Texas Secretary of State to understand the naming process better.

Step 2: Designate a Registered Agent

Next, you need to designate an agent registered with the Texas Secretary of State. The agent can be an individual or a company, but has to be someone who will be completely responsible for handling relevant legal documents on behalf of your company.

There are two major requirements the agent is expected to fulfill. Firstly, the agent must have a physical address in Texas. Secondly, the agent must be present in-person for accepting services on behalf of your company.

Note that your LLC itself can’t act as the agent. Moreover, the agent must be over 18 years of age, and must have the authorization to transact business within the state.

Step 3: File Your Paperwork

To form an LLC in Texas, you need to file two forms. These are as follows:

Form 205:

The first one is “Certificate of Formation- Limited Liability Company”. This is the most important form in the whole LLC formation process. You can download this and mail it, or fill it up directly through their SOSDirect website.

The filing fee for this form is $300. If you file it online, the cost will be $308.

Form 304:

If your LLC is already established outside the state of Texas and you want to open a branch in Texas too, you must file the form 304 as well. This form is an “Application for Registration of Foreign Limited Liability Company”. The filing fee for this form is $750.

Completing the Certificate of Formation

While filling up the certificate of formation, you’re required to provide the following data:

- You have to provide the full name of your LLC following the discussed regulations.

- Must include all relevant information about the registered agent

- Must specify the management structure of your LLC, for example, if it’s managed by members or managers.

- You should briefly discuss the purpose of the company.

- If you’d prefer having a mailing address separate from the business address, mention that.

- There’s an additional box where you can put supplemental information for additional provisions you’d like for your LLC.

- If you want to form the LLC for a specific period, you need to mention that. Otherwise, it’ll exist perpetually.

- Mention the date of formation for your LLC. You also get the option to choose if it’s a future event, but the formation must take place within 90 days of signing the form.

| Name | Normal Processing Time | Expedited Processing Time |

| Texas LLC by Mail | 4-8 weeks (Plus the mail time) | 4-5 business days (Plus mail time) |

| Texas LLC Online with SOSDirect | 10-12 business days | Not available |

| Texas LLC Online with SOSUpload | 13-15 business days | Not available |

Step 4: Drafting an Operating Agreement

The operating agreement is a document that shows who owns the LLC. Not only that, but it also sets factors such as how many people are managing the company, benefit distribution amongst the members, in which direction the company will go forward, etc.

An operating agreement is important because it helps you prove that your LLC is functioning properly. It can help you if you ever have to prove the legitimacy of your business in court.

Another reason as to why you should have an operating agreement is that you really don’t need to file it with the IRS or the state. It’s an internal document that you need to keep with your other business records.

Step 5: Get an Employer Identification Number (EIN)

The requirement of EIN is only a necessity when you have Individual Taxpayer Identification Number (ITIN). An EIN number is basically the Federal Employer Identification Number, also referred to as the Federal Tax ID number. You can get the EIN number for free, and if you apply for it online, it’ll take barely 15 minutes for you to get one. Filing one via mail can take up to three months.

Step 6: File an LLC Franchise Tax and Public Information Report

One more important step in the process is filing an LLC franchise tax form. LLCs aren’t required to pay reporting fees or file an annual report. You still have to pay the State Franchise Tax. This tax is billed annually, and you need to pay up before 15th of May.

Conclusion

As you can see, filing an LLC formation file in Texas isn’t that hard. However, you may still make a mistake, in which case you’re required to file a certificate of Correction.

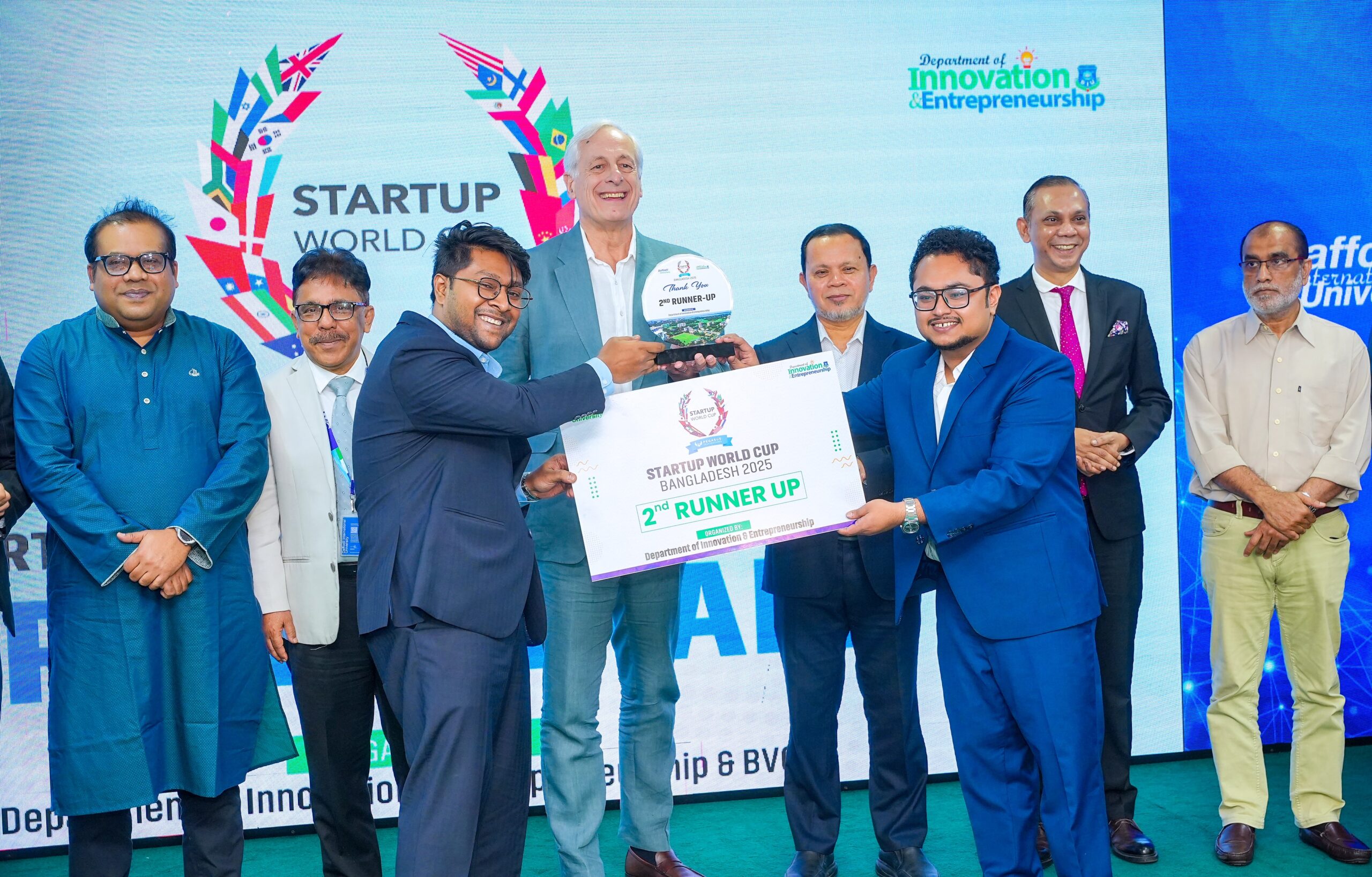

This is where Rocket Wave can help! We’re a registered agent in the State of Texas who can help you form your LLC, and make the process a breeze. We also offer further benefits such as helping you file the annual franchise tax, and so on.

So, if you’re considering forming an LLC in Texas, why don’t you reach out? Our team of experts can help you determine how forming LLC in Texas can help you!