An in-depth look at Payment Processor, Gateway, and Aggregator

Navigating the world of online payments can be complex, but understanding the key components can make it easier. Here’s a comprehensive guide to payment processors, payment gateways, and payment aggregators, including their definitions, examples, differences, pros and cons, and how they can benefit your business.

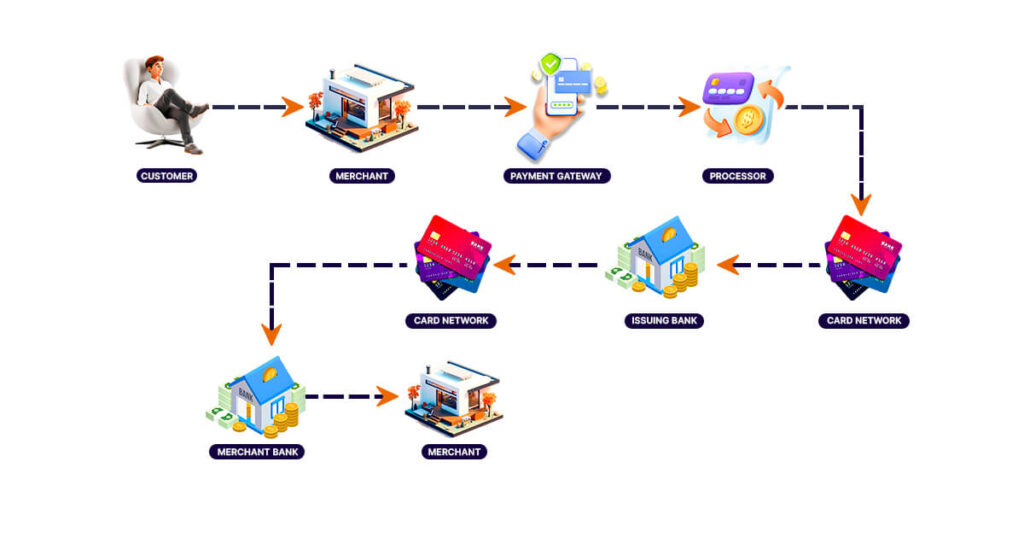

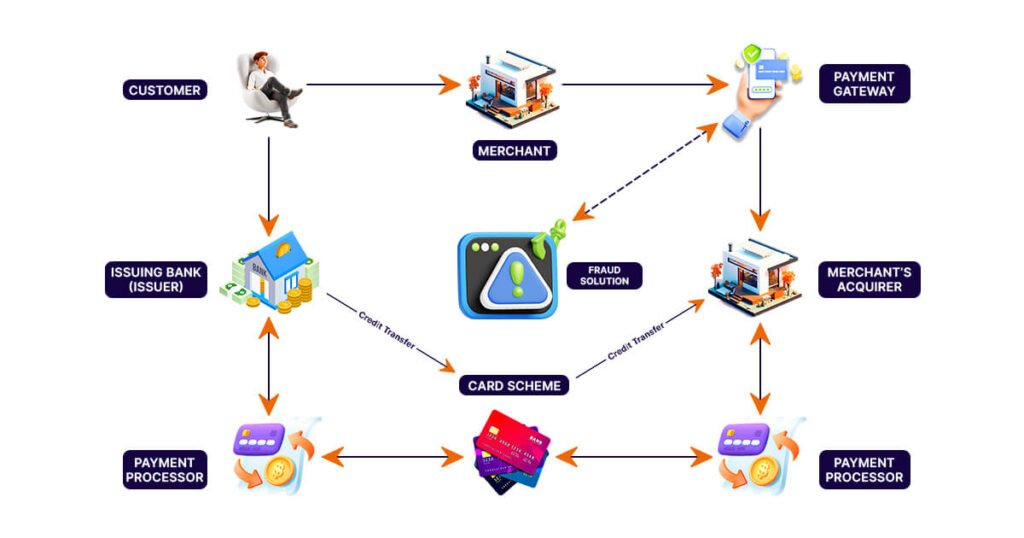

Payment Processor: A service that handles the transaction data between the customer’s bank and the merchant’s bank. It ensures the transaction is approved and funds are transferred. Examples: Elavon Payments, Stax Payment, World Pay, etc.

Key Functions:

- Transaction Authorization: Ensures funds are available in the customer’s account and authorizes the transaction.

- Data Transmission: Transfers transaction details securely between the merchant, acquiring bank, and issuing bank.

- Settlement: Facilitates the actual transfer of funds from the customer’s account to the merchant’s account.

Payment Gateway: A technology that captures and transfers payment data from the customer to the acquirer. It is a key component of the transaction process, encrypting sensitive information to ensure the security of the transaction. Example: Authorize.net, Payflow Pro, NMI, etc.

Key Functions:

- Encryption: Secures sensitive information such as credit card numbers to ensure that data passed between the customer and merchant remains private.

- Authorization: Works with the payment processor to authorize the transaction.

- Integration: Can be integrated into a website or mobile app to facilitate the checkout process.

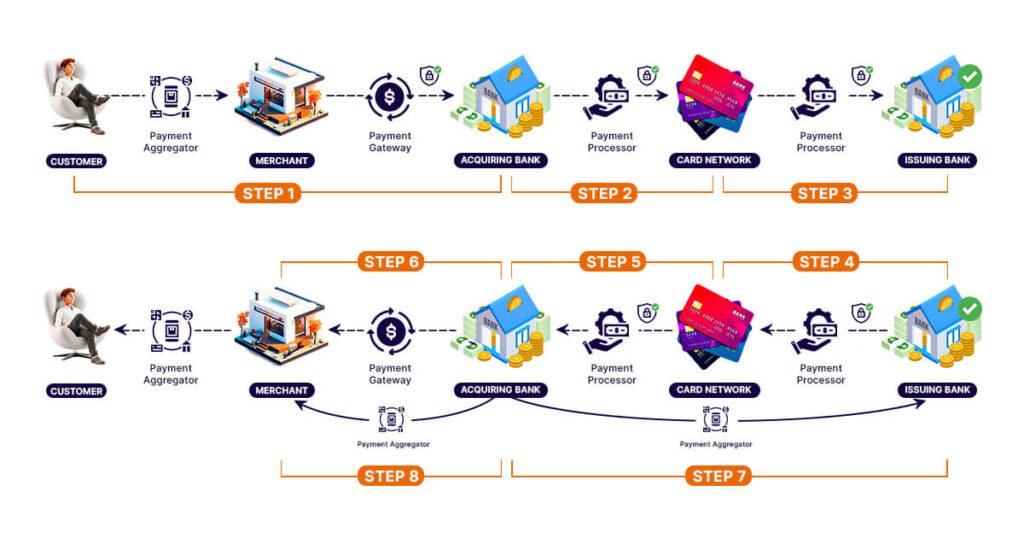

Payment Aggregator: A service provider that allows merchants to accept credit card and bank transfers without having to set up a merchant account with a bank. They pool payments and manage the funds on behalf of the merchants. Example: Square, Zoho Stripe, PayPal, etc.

Key Functions:

- Simplified Onboarding: Easier and faster setup compared to traditional merchant accounts.

- Fund Management: Collects payments on behalf of merchants and then disburses funds to them.

- Risk Management: Aggregators manage fraud risk and compliance on behalf of the merchants.

Here is a summarized differential table between payment processors, payment gateways, and payment aggregators:

| Feature | Payment Processor | Payment Gateway | Payment Aggregator |

| Definition | Handles transaction data between banks | Captures and transmits payment data | Allows merchants to accept payments without a merchant account |

| Function | Authorizes, processes, and settles transactions | Encrypts, transmits, and authorizes transactions | Pools payments and manages funds on behalf of merchants |

| Examples | Elavon Payments, Stax Payment, World Pay | Authorize.net, Payflow Pro, NMI, etc. | Square, Zoho Stripe, PayPal, etc. |

| SetupComplexity | Requires a merchant account, can be complex | Integrates with processors, moderate setup complexity | Easy setup, does not require a merchant account |

| Security | High-level security and fraud detection | Provides encryption and secure data transmission | Manages fraud risk and compliance |

| Costs | May include setup fees, transaction fees, monthly fees | Additional gateway fees, setup costs | Higher transaction fees, usually no setup costs |

| Pros | Reliable, high security, supports multiple methods | Secure, integrates with multiple processors | Easy setup, lower upfront costs |

| Cons | Can be expensive, requires a merchant account | Additional fees, potential integration complexity | Higher transaction fees, potential for account holds |

This table provides a quick comparison to help businesses understand the key differences and choose the right payment solution based on their needs.

US LLC Formation and Payment Gateway Setup

Forming a US LLC can provide credibility and legal benefits for your business. Once you have an LLC, you can open a business account on platforms like Stripe, PayPal, Payoneer, and Square to manage your business transactions efficiently.

Rocket Wave can help you form your US LLC and guide you through choosing the right payment gateway for your needs.

Conclusion

Understanding the differences between payment processors, gateways, and aggregators is crucial for selecting the right solution for your business. By leveraging services like Stripe, PayPal, Payoneer, and Square, and with the assistance of Rocket Wave, you can ensure smooth and secure transactions that will help your business thrive globally.