Closing your US LLC (Limited Liability Company) in New York is not an easy task and if it has to be undertaken, it has to be well-planned and drafted. Whether you are closing the business completely, changing the business structure, or are in the process of liquidating your LLC, it is important to observe the correct sequence for compliance and ease of closure. This article will help you step by step towards closing your New York LLC, starting from the decision to apply for dissolution to getting rid of the debts and informing the authorities.

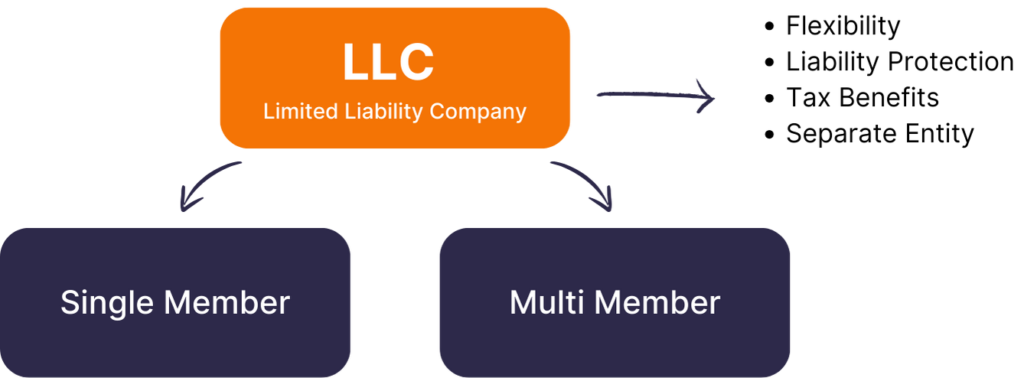

Understanding the US LLC Structure

A US LLC (Limited Liability Company) is a popular business structure in New York and across the United States due to its flexibility, liability protection, and tax benefits. Whether you operate a single-member LLC or a multi-member LLC, the company is considered a separate legal entity from its owners, providing limited liability protection. However, when the time comes to close your LLC, the process requires careful attention to legal and tax obligations.

How to Approach the Process of LLC Closure in New York

Without further ado, let’s get into the details and try to explain the main steps on how to deal with the LLC dissolution in New York. The process involves a few major stages aimed at ensuring that all legal or compliance requirements and financial demands are settled.

Step 1: Review Your Operating Agreement

The first step in closing your US LLC is to review your operating agreement. This document generally includes information regarding the procedures and steps for closing your LLC. If your LLC does not have any operating agreement, you need to New York state laws regarding the dissolution.

Your operating agreement may provide that all the members of the company will be required to vote on the matter, especially where there are several members in the LLC. It’s important to document this decision in writing, as it will serve as the official record of the decision to dissolve the LLC.

Step 2: Obtain Member Approval

For a multi-member LLC, obtaining member approval is a crucial step. All the members must consent to the decision of dissolution and this should be captured in a formal resolution. For single member LLC of course this step is simpler.

The decision to dissolve the LLC has also to be recorded in the records of the LLC. This documentation will be required when filing the Articles of Dissolution with the New York Department of State.

Step 3: File the Articles of Dissolution

To conclude your LLC in New York, it is compulsory to submit the Articles of Dissolution to the New York Department of State. This action dissolves your LLC and removes it from the state’s records.

Filing Fee: The Submission of the Articles of Dissolution, comes with a dissolution fee, which applies in currently active guidelines. A filing fee is only applicable when a request is being submitted.

- The Articles of Dissolution will require you to provide specific information, including:

- Name of the LLC with the date of registration

- The reason behind the dissolution

- A statement confirming that all claims, liabilities, and other obligations have been settled.

- The date of dissolution as stated in the articles of dissolution (if different from the filing date)

Here’s a table that lists the Articles of Dissolution filing fee for every state in the USA. Please note that these fees can change, so it’s important to check with the respective state’s official website or contact their Secretary of State office for the most current information.

| State | Filing Fee |

| Alabama | $100 |

| Alaska | $25 |

| Arizona | $35 |

| Arkansas | $50 |

| California | $0 |

| Colorado | $10 |

| Connecticut | $50 |

| Delaware | $204 |

| Florida | $25 |

| Georgia | $10 |

| Hawaii | $25 |

| Idaho | $20 |

| Illinois | $5 |

| Indiana | $30 |

| Iowa | $5 |

| Kansas | $35 |

| Kentucky | $40 |

| Louisiana | $75 |

| Maine | $75 |

| Maryland | $100 |

| Massachusetts | $100 |

| Michigan | $10 |

| Minnesota | $25 |

| Mississippi | $25 |

| Missouri | $25 |

| Montana | $15 |

| Nebraska | $15 |

| Nevada | $100 |

| New Hampshire | $35 |

| New Jersey | $100 |

| New Mexico | $50 |

| New York | $60 |

| North Carolina | $30 |

| North Dakota | $20 |

| Ohio | $50 |

| Oklahoma | $50 |

| Oregon | $100 |

| Pennsylvania | $70 |

| Rhode Island | $50 |

| South Carolina | $10 |

| South Dakota | $10 |

| Tennessee | $20 |

| Texas | $40 |

| Utah | $70 |

| Vermont | $25 |

| Virginia | $25 |

| Washington | $20 |

| West Virginia | $25 |

| Wisconsin | $10 |

| Wyoming | $50 |

Once you have filed the Articles of Dissolution it means you have dissolved the LLC. However, there are other complications and measures which you need to follow still.

Step 4: Settle the Remaining Obligations

Before your LLC can be fully dissolved, you need to ensure that all outstanding liabilities are settled. This includes:

Paying off Debts: Ensure that all creditors have been paid and that LLC has no outstanding depts.

Filing Final Tax Returns: Submit your final tax returns to both the IRS and the New York State Department of Taxation and Finance. This includes any outstanding sales tax returns, employment, and other applicable taxes.

Canceling Licenses and Permits: Cancel all the business addresses, licenses and permits, and registration documents associated with your LLC.

Pending Annual Reports: Any overdue annual reports must be submitted before moving to close the LLC.

Completing these liabilities assures that there will be no undue lingering obligations that can come back to haunt you after the LLC is dissolved.

Step 5: Notify the IRS and other authorities concerned

Generally, upon filing the Articles of Dissolution, it is important to notify the IRS regarding the dissolution of the LLC, and this also means canceling the EIN. You should also inform other relevant authorities, such as the New York State Department of Taxation and Finance, about the dissolution.

Step 6: Cancel Business Accounts and Services

Once you have decided to dissolve your LLC, you must close any business accounts and cancel your ongoing services associated with the LLC. This includes business insurance policies, utility accounts, and any contracts in the LLC’s name.

By closing these accounts, you ensure that no further transactions can occur under the LLC’s name, protecting yourself from future liabilities.

Step 7: Keep Records of the LLC Closure

While the steps outlined above provide a general guide to closing your US LLC in New York, the process can vary depending on your specific situation. For example, suppose your LLC has multiple members, significant assets, or outstanding legal issues. In that case, you may need to seek legal advice or hire a professional service to assist with the dissolution process.

With the help of Rocket Wave’s professional consultation services, LLC dissolution can become relatively easy and all obligations satisfied, both legal and financial.