An Individual Taxpayer Identification Number (ITIN) is a crucial tool for non-resident aliens who need to file U.S. tax returns. This guide explores everything you need to know about ITINs, including their purpose, benefits, eligibility requirements, and the application process.

What is an ITIN?

An ITIN is a tax processing number issued by the Internal Revenue Service (IRS) to individuals who do not qualify for a Social Security number (SSN) but still need to file a U.S. tax return. It allows you to report your income earned in the US and claim any applicable tax benefits. Please note that only owners of a US LLC or US C-Corp are eligible to apply for an ITIN.

Benefits of Obtaining an ITIN:

Opening banks and compliances:

1. Filing US Tax Returns:

The primary benefit of an ITIN is the ability to file U.S. tax returns. This is crucial if you have income sourced from the US, such as:

- Wages earned while working in the US (even if temporarily)

- Rental income from property located in the US

- Income from investments held in the US

By filing a tax return with an ITIN, you ensure you comply with US tax regulations and avoid potential penalties.

2. Claiming Tax Benefits (Potential):

An ITIN might allow you to claim certain tax benefits depending on your specific circumstances and the terms of any applicable tax treaties between your home country and the US. These benefits could include:

- Tax treaty benefits: Tax treaties between countries can reduce tax withholding rates on certain types of income. An ITIN could be essential to claim these benefits if you qualify under the specific treaty.

- Earned Income Tax Credit (EITC): In some cases, low- to moderate-income earners with ITINs may be eligible for the EITC, which is a refundable tax credit that can reduce your tax liability or even result in a tax refund.

Important Note: Eligibility for tax benefits is complex and depends on various factors like your income, filing status, and the specific tax treaty between your home country and the US. It’s highly recommended to consult with a tax professional to determine which benefits you might qualify for.

3. Opening Bank Accounts (Limited Benefit):

An ITIN may be helpful in some cases for opening a bank account in the US. However, it’s not a guaranteed benefit, and each bank has its policies. Here’s what to consider:

- Not Universally Accepted: Many banks require a Social Security number (SSN) for opening an account.

- Alternative Requirements: If a bank accepts ITINs, they might require additional documentation, such as a passport, visa, and proof of address.

- Explore Options: If opening a bank account is a priority, research banks that are known to accept ITINs or offer accounts specifically for non-resident aliens.

4. Opening Payment Gateways:

- Limited Usefulness: An ITIN itself typically will be needed to open a payment gateway account (e.g., Stripe, PayPal). These platforms often require a Social Security number (SSN) for verification.

- Alternative Options: Some payment gateways may allow you to open an account with an ITIN in combination with other documents, such as a passport, visa, and proof of business registration (if applicable). However, this is not a universal policy, and it’s best to check with the specific payment gateway provider for their requirements.

5. Building Personal Credit History:

- Indirect Impact: An ITIN doesn’t directly build your credit history. Credit bureaus (Experian, Equifax, TransUnion) typically rely on SSNs to track credit activity.

- Building with Alternative Methods: There are alternative ways to establish credit history in the US even with an ITIN:

- Become an authorized user: If you have a friend or family member with good credit who is willing to add you as an authorized user on their credit card, their positive credit activity can be reflected on your credit report.

- ITIN-based credit products: A limited number of lenders offer credit cards or loans specifically for non-resident aliens using ITINs. These products can help build credit history but often come with higher interest rates and stricter requirements.

Important Considerations:

- An ITIN does not grant work authorization or change your immigration status.

- It’s solely for tax filing purposes.

Who Can Apply for an ITIN?

- Non-resident aliens with U.S. source income (wages, rental income, etc.)

- Dependents of U.S. citizens or residents who are not eligible for SSNs (e.g., children born abroad, spouses without SSNs)

Who Cannot Apply for an ITIN?

- U.S. citizens or residents (apply for an SSN instead)

- Certain visa holders (check IRS guidelines for your specific visa)

How to Apply for an ITIN:

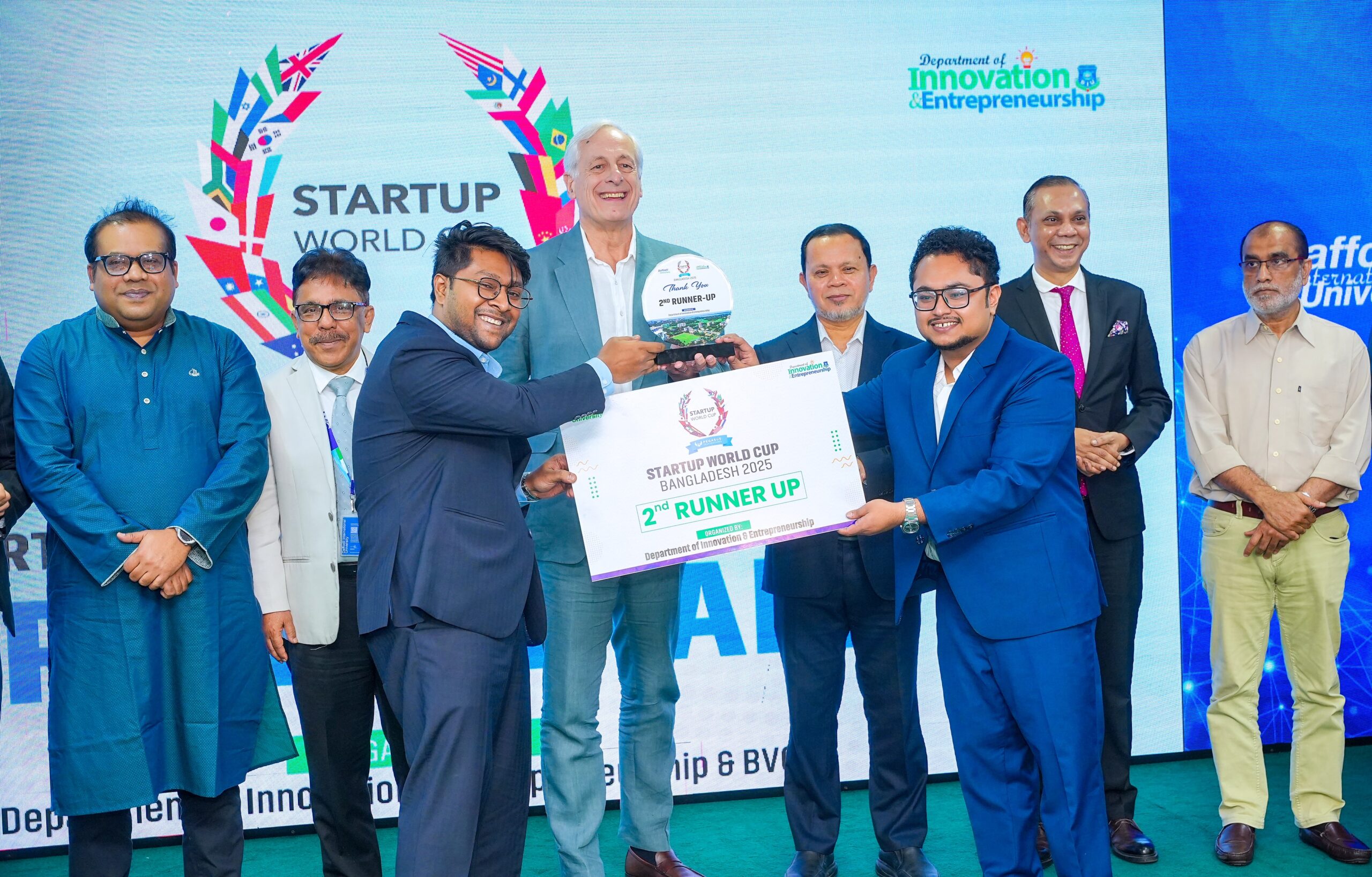

At Rocket Wave Business Services, we understand the complexities of navigating US tax regulations as a non-resident. Our experienced team can assist you with your ITIN application process through our $300 ITIN service package.

- Fill Out the Online Form Enter the required details about your business and personal information to start your ITIN application.

- Application Processing Rocket Wave will submit your application to the IRS, ensuring all necessary documentation is included.

- Get Your ITIN Once approved, you’ll receive your ITIN, ready for use in tax reporting, banking, and other essential business operations.

This package includes:

- Consultation: Discuss your specific situation and determine eligibility.

- Document Preparation: We help you gather and organize the necessary documentation.

- Application Assistance: Guide you through completing Form W-7 accurately.

- Application Submission: Ensure your application is properly submitted to the IRS.

Why Choose Rocket Wave for getting your ITIN?

- Streamlined Process: We simplify the ITIN application process, saving you time and effort.

- Expert Guidance: Our team provides professional guidance and support throughout the process.

- Peace of Mind: Gain confidence knowing you have a reliable partner by your side.

Obtaining an ITIN is essential for non-resident taxpayers filing U.S. tax returns. Get started with Rocket Wave‘s smooth application process to obtain your ITIN.