Introduction

You’ve built an amazing product or provide extraordinary services, landed your first international clients, and you’re ready to lock your deal and accept payments. Then reality hits: Stripe, PayPal Business, and most major payment processors reject your application because you don’t have a US business entity or banking presence. This frustrating roadblock stops countless talented entrepreneurs from Bangladesh, India, Nepal, and other countries from scaling their businesses globally.

The challenge isn’t your product quality or business viability—it’s simply that payment processors for non-US residents operate under strict regulatory requirements that favor domestic businesses. But here’s the good news: obtaining a Stripe account for non-US residents is absolutely possible in 2026, and thousands of international entrepreneurs are successfully processing payments through Stripe right now.

At Rocket Wave, we’ve helped hundreds of non-resident business owners navigate the path from rejection to approval. Whether you’re running a SaaS business, e-commerce store, freelance service, or subscription platform, understanding the requirements for international payment processing and following the right setup sequence makes all the difference between endless rejections and smooth approval.

This comprehensive guide reveals exactly how to get approved for Stripe as a non-US resident, including the proper entity structure, required documentation, banking solutions, and proven strategies that actually work in 2026.

Why Stripe Matters for International Entrepreneurs

Before diving into the approval process, let’s understand why Stripe for non-residents is worth the effort compared to countless other payment solutions available.

Industry-Leading Payment Processing

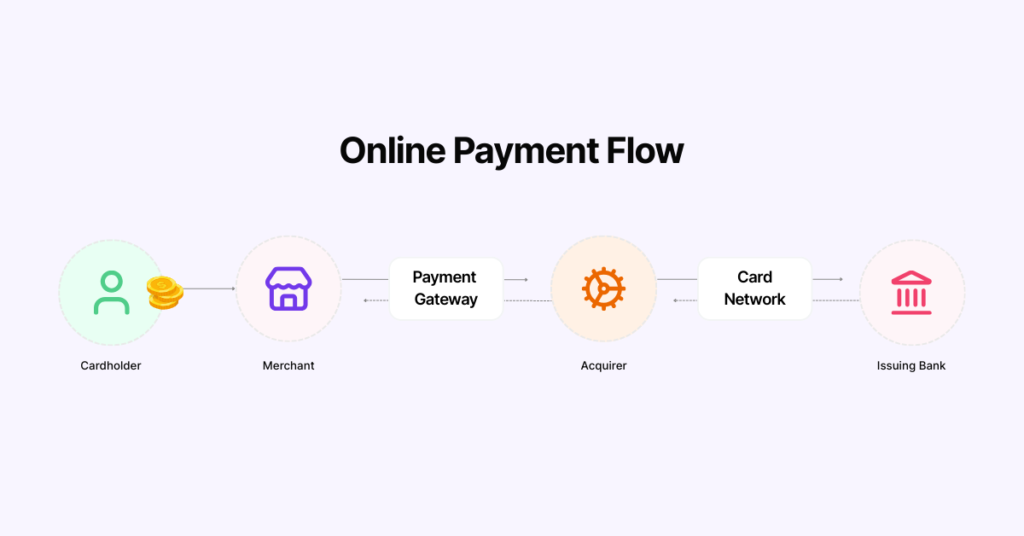

Stripe has become the gold standard for online payment processing, powering millions of businesses worldwide including major platforms like Shopify, Lyft, and Amazon. The platform offers acceptance of all major credit and debit cards globally, support for 135+ currencies and local payment methods, industry-low processing fees (2.9% + 30¢ per transaction), and seamless integration with virtually every platform and framework. According to Stripe’s official documentation, their API handles billions of dollars in transactions annually with 99.99% uptime.

Superior Developer Experience

For tech entrepreneurs and SaaS founders, Stripe’s developer-friendly approach is unmatched. Well-documented APIs and extensive libraries, powerful webhooks for real-time event handling, comprehensive testing environment with realistic scenarios, and flexible customization options for unique business models make development smoother. This technical excellence is why international payment gateway solutions built on Stripe consistently outperform alternatives.

Built-In Features That Scale With Your Business

Beyond basic payment processing, Stripe provides subscription and recurring billing management, fraud detection and prevention tools (Stripe Radar), automated invoice generation and management, revenue recognition and financial reporting, and integration with accounting software and tax platforms. These features would cost thousands of dollars if purchased separately, making Stripe an incredibly cost-effective solution for cross-border payment processing.

Trust and Credibility

Having “Powered by Stripe” on your checkout page immediately signals legitimacy to customers. In markets where online payment fraud is common, Stripe’s reputation provides assurance that builds customer confidence, reduces cart abandonment, and increases conversion rates. For non-resident entrepreneurs trying to establish credibility, this trust factor is invaluable.

Global Reach With Local Optimization

Stripe enables you to accept payments from customers worldwide while providing localized experiences through support for local payment methods (Alipay, iDEAL, SEPA), dynamic currency conversion, multi-language checkout pages, and compliance with regional regulations (PSD2, SCA). This global payment solution approach means you can serve customers in Europe, Asia, and the Americas with equal effectiveness.

Understanding Stripe’s Requirements for Non-Residents

The key to Stripe approval for foreigners is understanding exactly what Stripe requires and why. Many rejections happen because applicants don’t meet fundamental prerequisites.

Business Entity Requirements

Stripe doesn’t allow personal accounts for commercial transactions. You need a legitimate business entity, and for non-US residents, this typically means a US LLC. Here’s why a US LLC for Stripe account is the most viable path:

Why US LLC works:

- Stripe has established procedures for US-registered businesses

- US banking infrastructure integrates seamlessly with Stripe

- Clear regulatory framework Stripe is comfortable with

- Proven track record with thousands of non-resident LLC owners

Alternative entity types (less common):

- UK Limited Company (if you can establish UK banking)

- Singapore Private Limited (higher costs but viable)

- EU entities in Stripe-supported countries

- Other jurisdictions where Stripe operates

For most international entrepreneurs seeking payment processing, the US LLC route offers the best balance of accessibility, cost, and approval likelihood. Learn more about US LLC formation from Bangladesh as your foundation for Stripe access.

Banking Requirements

This is where many non-residents hit roadblocks. Stripe requires a business bank account in the same country as your business entity. For a US LLC, you need a US business bank account.

Traditional bank challenges:

- Most require in-person visits to US branches

- Strict documentation requirements

- Long approval processes (weeks to months)

- Often reject foreign owners without US presence

Fintech solutions that work:

- Mercury – Popular choice, 100% online, designed for startups

- Wise Business (formerly TransferWise) – Multi-currency support, accepted by Stripe

- Relay – Free business banking, non-resident friendly

- Brex – Startup-focused, though has higher approval standards

The critical factor: Your bank must provide US routing and account numbers. International banks or accounts that only offer SWIFT/IBAN codes won’t work for Stripe integration. For detailed guidance, check our US bank account guide for non-residents.

Tax Identification Requirements

You need an EIN (Employer Identification Number) from the IRS for your LLC. This serves as your business tax ID and is required for both banking and Stripe applications.

EIN application for non-residents:

- Cannot use the online IRS system (restricted to US entities with SSN)

- Must apply by phone (+1-267-941-1099) or fax

- Typically takes 1-5 business days

- Completely free (beware of services charging excessive fees)

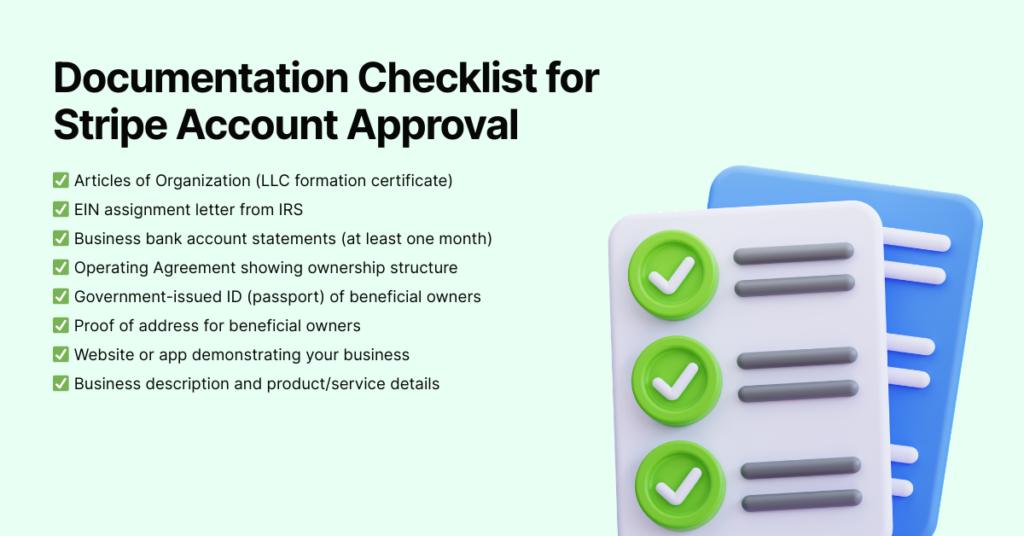

Documentation Checklist

Stripe’s verification process requires specific documents. Missing even one can delay or derail approval:

Essential documents:

- ✅ Articles of Organization (LLC formation certificate)

- ✅ EIN assignment letter from IRS

- ✅ Business Address Verification (accepted documents: Utility Bill, Lease/ Rental Agreement, Bank Statement, etc.)

- ✅ Operating Agreement showing ownership structure

- ✅ Government-issued ID (passport) of beneficial owners

- ✅ Proof of address for beneficial owners (accepted documents: Insurance, Utility Bill, Lease/ Rental Agreement, Bank Statement, etc.)

- ✅ Website or app demonstrating your business

- ✅ Business description and product/service details

Optional but helpful:

- Business licenses (if applicable to your industry)

- Invoices or contracts showing business activity; US-Nexus

- Customer testimonials or case studies

- Professional business email address

Website and Business Legitimacy Requirements

Stripe manually reviews applications and evaluates business legitimacy. Your online presence matters significantly:

Website requirements:

- Professional design (not a basic template)

- Clear description of products/services

- About page with company information

- Terms of Service and Privacy Policy

- Contact information (email, potentially phone)

- SSL certificate (https://)

- Return/refund/service policy for products/services

Red flags that trigger rejection:

- Generic or placeholder content

- No clear business model

- Suspicious or high-risk industries

- Poor English or unprofessional presentation

- Missing legal pages (ToS, Privacy Policy)

- Inactive or under-construction sites

Step-by-Step Guide to Getting Stripe Approval as a Non-Resident

Follow this proven sequence to maximize your Stripe approval chances and avoid common pitfalls that lead to rejection.

Step 1: Form Your US LLC (Foundation)

Everything else depends on having a properly formed US business entity. Don’t skip corners here.

Choose the right state: For Stripe purposes, any US state works, but Wyoming, Delaware, and New Mexico are popular for their business-friendly environments and low costs. Your state choice won’t affect Stripe approval—what matters is having a valid US LLC.

Complete formation properly:

- File Articles of Organization with your chosen state

- Obtain certified copies of formation documents

- Create a comprehensive Operating Agreement

- Ensure all documents have correct member information

Timeline: 1-2 weeks including processing time

Costs: $50-500 depending on state and whether you use a formation service

Get started with LLC formation through Rocket Wave’s streamlined process designed for international entrepreneurs.

Step 2: Obtain Your EIN

Your Employer Identification Number is required for banking and Stripe applications.

Application process for non-residents:

Option A – Phone application (fastest):

- Call IRS international line: +1-267-941-1099

- Available Monday-Friday, 6am-11pm EST

- Have LLC formation documents ready

- Receive EIN immediately during call

- Get confirmation letter mailed to registered agent

Option B – Fax application:

- Complete Form SS-4 accurately

- Fax to (855) 641-6935

- Receive EIN within 4-5 business days

- More reliable than mail option

Option C – Mail Application (Not Recommended):

- Fill the SS-4 form in the IRS website.

- Print out a copy and sign it.

- Mail it to the IRS’s EIN Operations Office in Cincinnati, Ohio.

- Typically takes 4-5 weeks to get back a copy of the EIN. Depending on geo-location may take more.

- Complex process and correspondence.

Option D – Telephonic Application (Upon Discretion):

- Call IRS’s international line: +1-267-941-1099

- Beforehand; fill the SS-4 form in the IRS website and have a copy ready with you.

- Fax the SS-4 as per instructions by the IRS representative.

- Receive EIN immediately during call, upon processing.

- Get confirmation letter mailed to registered agent.

- Note that, the waiting time in the call may take a while, call with time in hand.

Common mistakes to avoid:

- Applying before LLC is officially formed

- Incorrect responsible party information

- Missing or incomplete business address

- Trying to use the online system (won’t work for foreigners)

Cost: Free (direct with IRS)

Step 3: Open Your US Business Bank Account

This is often the most challenging step for non-resident business owners, but several proven solutions exist.

Recommended banking solution – Mercury:

Mercury has emerged as the top choice for non-resident LLC owners seeking Stripe integration.

Why Mercury works well:

- 100% online application, no US visit required

- Specifically designed for startups and online businesses

- High approval rate for foreign founders

- Provides US routing + account number (required for Stripe)

- No minimum balance or monthly fees

- Excellent integration with Stripe and other tools

Mercury application process:

- Create account at mercury.com

- Complete KYB- Know Your Business (provide formation docs)

- Complete KYC- Know Your Customer; and verify identity (passport, selfie)

- Describe your business model

- Wait for approval (typically 1-3 business days)

- Receive account credentials and routing number

Documents needed for Mercury:

- LLC Articles of Organization

- EIN confirmation letter

- Passport of all beneficial owners (25%+ ownership)

- Proof of address for beneficial owners (accepted documents: Insurance, Utility Bill, Lease/ Rental Agreement, Bank Statement, etc.)

- Operating Agreement

- Business description (be detailed and clear)

- Explanation of your business model

Alternative banking options:

Wise Business (formerly TransferWise):

- Multi-currency account with US banking details

- Easier approval than Mercury for some applicants

- Better for international transactions

- Works with Stripe (confirm current compatibility)

Relay:

- Free business banking

- Non-resident friendly

- Growing acceptance among payment processors

- Good alternative if Mercury declines

What if you get rejected?

- Provide more detailed business information

- Strengthen your web presence before reapplying

- Try alternative banks (Relay, Wise)

- Consider consulting with a banking specialist

- Ensure all documentation is clear and professional

Timeline: 1-7 days for approval, 3-5 days for account activation

Costs: Most fintech options are free; traditional banks charge $15-30/month

Step 4: Build Your Business Presence

Before applying to Stripe, ensure your business is legitimate and operational.

Website essentials:

Create or improve your website with these critical elements:

- Professional design: Use quality themes (WordPress, Webflow, Squarespace)

- Clear value proposition: Explain what you do within 5 seconds

- Product/service pages: Detailed descriptions with benefits

- Pricing information: Transparent pricing builds trust

- About page: Tell your story, show your team

- Contact page: Email, potentially phone, physical address

- Legal pages: Terms of Service, Privacy Policy, Refund Policy

Use professional tools:

- Quality domain (avoid free subdomains)

- Business email (@yourdomain.com, not Gmail)

- SSL certificate (https://)

- Professional hosting (not free hosting)

Industry-specific requirements:

Some business types need additional legitimacy markers:

- E-commerce: Product photos, inventory, shipping policies

- SaaS: Working demo, feature documentation, use cases

- Services: Portfolio, case studies, testimonials

- Subscriptions: Clear billing terms, cancellation policy

Timeline: 1-2 weeks to build properly (or less if using existing site)

Costs: $10-50/month for hosting and tools

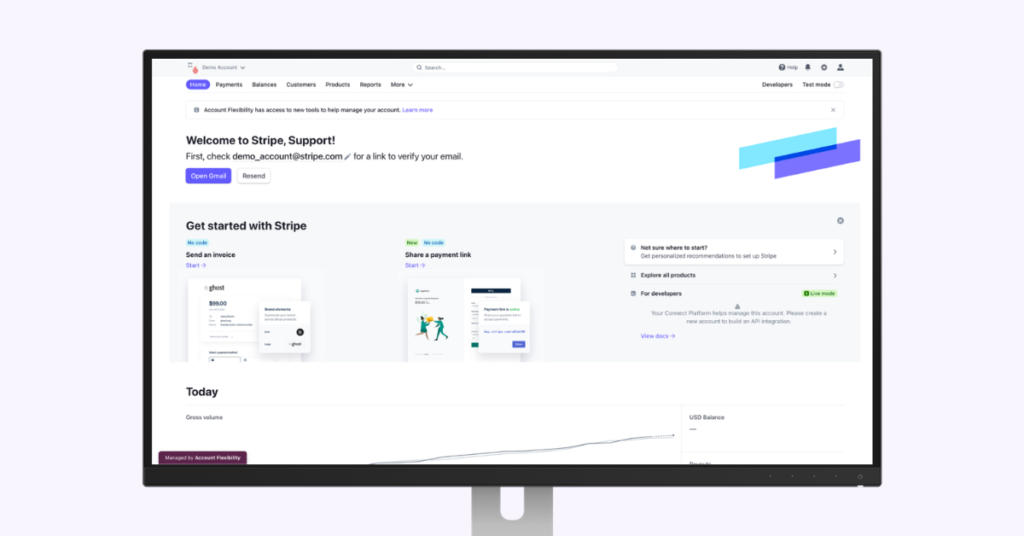

Step 5: Prepare Your Stripe Application

With foundation elements in place, carefully prepare your Stripe application.

Create your Stripe account:

Go to stripe.com and click “Start now” or “Sign up.” Use your business email address (critical for credibility). Provide accurate information matching your LLC documents.

Business information required:

You’ll need to provide:

- Legal business name (exactly as on LLC documents)

- Business address (US address from LLC formation)

- EIN (from IRS)

- Business type (LLC)

- Industry/business category

- Product/service description

- Website URL

- Estimated processing volume

Bank account connection:

Link your US business bank account:

- Enter routing number and account number

- Verify micro-deposits (Stripe sends small amounts)

- Confirm account ownership

- This step may take 1-2 business days

Identity verification:

Stripe requires verification of beneficial owners (anyone owning 25%+ of LLC):

- Full legal name

- Date of birth

- Home address

- Government ID (passport for non-residents)

- Potentially SSN (not required for non-US persons)

Be transparent about:

- Your non-resident status

- Business operations from outside US

- Customer base and target market

- Fulfillment/service delivery process

Timeline: Application takes 30 minutes; verification takes 1-3 business days

Step 6: Navigate the Verification Process

Stripe’s verification team will review your application. Here’s what to expect and how to handle it.

What Stripe reviews:

- Business legitimacy and documentation

- Website quality and completion

- Industry risk level

- Banking connection validity

- Owner identity verification

- Consistency across all information

Common verification requests:

- Additional documentation about business model

- Clarification on products/services offered

- Proof of business operations (invoices, contracts)

- Explanation of international ownership structure

- Bank statements showing business activity

How to respond effectively:

If Stripe requests additional information:

- Respond quickly (within 24 hours if possible)

- Be comprehensive (provide more than asked)

- Stay professional (clear, business-like communication)

- Show legitimacy (multiple proof points)

- Explain clearly (assume reviewer has no context)

Timeline: 1-5 business days depending on complexity

Common Rejection Reasons and How to Overcome Them

Understanding why applications get rejected helps you avoid these pitfalls and increase your Stripe approval for international business chances.

Rejection Reason 1: Incomplete or Inconsistent Documentation

The problem: Information doesn’t match across documents, or required documents are missing.

Examples:

- LLC name on bank account differs from formation documents

- Address on EIN letter doesn’t match LLC address

- Operating Agreement shows different members than application

- Website domain registration doesn’t align with business name

How to fix:

- Ensure perfect consistency across ALL documents

- Double-check business name spelling

- Verify addresses match exactly

- Review all documents before submission

- Create a checklist and cross-verify

Prevention strategy: Use the same exact information everywhere from day one. Keep a master document with your official business details and copy from it consistently.

Rejection Reason 2: Weak or Incomplete Website

The problem: Website looks unprofessional, incomplete, or suspicious.

Red flags:

- “Under construction” or placeholder pages

- No clear product/service information

- Missing legal pages (ToS, Privacy Policy)

- Poor design suggesting lack of legitimacy

- No contact information

- Recent domain registration with no history

How to fix:

- Invest in professional website design

- Complete all essential pages before applying

- Add customer testimonials or case studies

- Include team information and company history

- Ensure mobile responsiveness

- Add trust signals (security badges, certifications)

Quick wins: Use quality WordPress themes like Astra or Kadence, implement professional page builders (Elementor, Divi), add live chat widget for credibility, include professional photography or graphics, and ensure fast loading times.

Rejection Reason 3: High-Risk Industry Classification

The problem: Your business falls into Stripe’s restricted or high-risk categories.

High-risk industries:

- Adult content or services

- Gambling or casino operations

- Cryptocurrency or forex trading

- Multi-level marketing

- Nutraceuticals or supplements

- Get-rich-quick schemes

- Weapons or explosives

How to handle: If you’re genuinely in these industries, Stripe may not be viable. Consider specialized high-risk payment processors like Durango Merchant Services or PaymentCloud. For borderline cases, clearly explain how your business differs from typical high-risk operations.

For mainstream businesses: If incorrectly categorized, provide clarification explaining your actual business model with supporting documentation, industry classification codes that apply, and examples of similar businesses using Stripe successfully.

Rejection Reason 4: Banking Connection Issues

The problem: Bank accounts can’t be verified or don’t meet requirements.

Common issues:

- Using personal account instead of business account

- International bank without US routing number

- Recently opened account with no history

- Failed micro-deposit verification

- Account name doesn’t match LLC

How to fix:

- Ensure business account is in LLC’s legal name

- Use fintech banks known to work with Stripe

- Wait for account to have some transaction history

- Verify micro-deposits carefully (common error point)

- Provide bank statement showing business activity

Pro tip: Make a few legitimate business transactions through your account before applying to Stripe. Even $100-500 in activity demonstrates an active business account.

Rejection Reason 5: Suspicious or Unclear Business Model

The problem: Stripe’s review team doesn’t understand how your business operates or suspects potential fraud.

Triggers:

- Vague product/service descriptions

- Unusually high projected processing volume

- Mismatch between website and stated business

- Drop-shipping or reseller models (sometimes flagged)

- No clear value creation

How to address:

- Provide extremely clear business model explanation

- Include examples of customer transactions

- Explain value you provide in the ecosystem

- If drop-shipping, emphasize your unique angle

- Demonstrate existing customer base

Sample clarification: “We operate a SaaS platform providing [specific function] to [target market]. Customers subscribe monthly at $[price] to access [features]. We handle [what you do] while integrating with [other tools]. Our differentiator is [unique value]. Current customers include [examples if possible].”

Rejection Reason 6: Non-Resident Owner Concerns

The problem: Stripe is concerned about international ownership and compliance.

Specific concerns:

- Ability to enforce terms with foreign owners

- Compliance with US regulations

- Customer service and dispute handling

- Potential fraud risk

How to address:

- Emphasize your US LLC structure and US bank account

- Explain how you’ll handle customer service (US hours, English)

- Demonstrate understanding of US consumer protection laws

- Show established business operations

- Provide references or track record if available

Strengthening factors:

- US phone number (Google Voice, Skype number)

- US business address (not just registered agent)

- Professional email and communication

- Clear refund and dispute policies

- Existing positive reviews or testimonials

Alternative Payment Processors for Non-Residents

While Stripe is ideal, having backup options ensures you can process payments regardless of Stripe’s decision.

PayPal Business

Pros:

- Widely recognized and trusted globally

- Easier approval for non-US residents

- Available in 200+ markets

- No monthly fees

Cons:

- Higher fees than Stripe (2.9% + $0.30 base, but varies)

- Reputation for freezing accounts

- Less developer-friendly

- Withdrawal holds for new accounts

Best for: E-commerce, services, established businesses with lower technical requirements

Setup requirements: Similar to Stripe but generally more lenient

Payoneer

Pros:

- Specifically designed for international businesses

- Easy approval for non-US residents

- Multi-currency support

- Marketplace integrations (Amazon, Upwork)

Cons:

- Higher fees (up to 3%)

- Limited customization

- Primarily for receiving payments, not full checkout

- Less suitable for subscriptions

Best for: Freelancers, marketplaces, international transactions

Setup: No US LLC required (though having one helps)

2Checkout (now Verifone)

Pros:

- Accepts international merchants easily

- Global payment methods support

- Recurring billing capabilities

- Good for digital products

Cons:

- Higher fees (3.5% + $0.35)

- Less popular than Stripe/PayPal

- Complex fee structure

- Monthly minimums may apply

Best for: SaaS, digital products, subscription businesses

Square

Pros:

- Easy setup and use

- Good for in-person + online

- Free POS hardware

- Quick funding

Cons:

- Requires US bank account

- Less flexible than Stripe

- Account freezing concerns

- Not ideal for international owners

Best for: Retail, restaurants, hybrid online/offline businesses

Non-resident challenge: Similar requirements to Stripe

Paddle

Pros:

- Merchant of record (handles all tax compliance)

- Excellent for SaaS

- Global payment support

- No need for US entity

Cons:

- Higher fees (5% + $0.50)

- Less control over customer relationship

- Paddle is the seller, not you

- Limited customization

Best for: SaaS businesses wanting simplified tax compliance

Setup: Much easier for non-residents than Stripe

Wise Business (Formerly TransferWise)

Pros:

- Multi-currency business account

- Excellent exchange rates

- Works in many countries

- Can receive payments internationally

Cons:

- Not a traditional payment processor

- Limited checkout integration

- Better for receiving than processing

- Requires invoicing workflow

Best for: International freelancers, consultants, B2B services

Maintaining Your Stripe Account After Approval

Getting approved is just the beginning. Maintaining good standing requires ongoing attention to payment processing compliance.

Understanding Stripe’s Monitoring

Stripe continuously monitors accounts for suspicious activity or policy violations. They track dispute rates (should stay below 0.75%), refund rates, processing volume spikes, customer complaints, and geographic transaction patterns.

What triggers reviews:

- Sudden spike in transaction volume

- High dispute or chargeback rates

- Unusual transaction patterns

- Customer fraud reports

- Multiple failed transactions

- Products/services changing significantly

Best Practices for Account Health

Maintain low dispute rates:

- Provide excellent customer service

- Clear product descriptions

- Transparent billing practices

- Easy refund process

- Quick response to customer issues

Manage chargebacks proactively:

- Use Stripe Radar for fraud prevention

- Verify suspicious transactions manually

- Maintain detailed transaction records

- Respond quickly to chargeback notices

- Provide compelling evidence for disputes

Stay compliant with policies:

- Review Stripe’s Acceptable Use Policy regularly

- Don’t process payments for prohibited items

- Maintain accurate business information

- Update Stripe if business model changes

- Keep all documentation current

Handling Verification Requests

Even after approval, Stripe may periodically request additional verification, especially when scaling volume or entering new markets.

Common requests:

- Updated bank statements

- Proof of product delivery

- Customer service records

- Inventory or service documentation

- Explanation of volume increases

Response best practices:

- Respond within 24-48 hours

- Provide more documentation than requested

- Explain any unusual circumstances

- Maintain professional communication

- Keep records organized for quick responses

Growing Transaction Volume Safely

Start conservatively: Don’t immediately process massive volume. Stripe’s systems flag unusual patterns, and going from $0 to $50,000 in your first week raises red flags.

Scale gradually:

- Month 1: $1,000-5,000

- Month 2: $5,000-15,000

- Month 3: $15,000-30,000

- Continue increasing steadily

Notify Stripe proactively: If you’re planning a major launch or campaign that will significantly increase volume, contact Stripe support in advance to explain the situation.

Tax Compliance Matters

Remember that accepting payments through Stripe doesn’t exempt you from US LLC tax obligations. Maintain proper records for all transactions, file required tax returns (Form 5472, etc.), understand nexus rules if selling physical products, and work with an international tax professional. Review our LLC compliance guide for detailed tax requirements.

Frequently Asked Questions

Can I get Stripe without a US LLC?

While Stripe operates in 46+ countries, getting approved as a non-US resident typically requires a US business entity. Stripe offers accounts in countries where they’re available (UK, Canada, Australia, EU countries, Singapore, etc.), but each requires local business registration. For entrepreneurs in Bangladesh, India, Nepal, and similar markets where Stripe doesn’t operate directly, forming a US LLC is the most reliable path. Some alternatives like Paddle or PayPal work without US entities, but they offer less flexibility and control than Stripe. The investment in US LLC formation ($100-500) is worthwhile given Stripe’s superior features and lower processing fees over time.

How long does Stripe approval take for non-residents?

Timeline varies based on application completeness and verification complexity. With all documentation prepared properly: instant account creation, 1-2 days for bank verification (micro-deposits), 1-3 business days for identity verification, and potentially 1-5 additional days if Stripe requests more information. Total timeline is typically 3-10 business days. However, if documentation is incomplete or concerns arise, it can extend to several weeks. The key is thorough preparation before applying. Having your US LLC, EIN, business bank account, and professional website ready before starting ensures fastest approval. Applications submitted with missing elements or weak business presence take much longer and have higher rejection rates.

What if my Stripe application is rejected?

Rejection isn’t permanent, but you need to address the root cause before reapplying. First, carefully read Stripe’s rejection explanation—they usually provide specific reasons. Common issues include incomplete documentation, weak web presence, or inconsistent information. Address each concern thoroughly before reapplying. If the rejection seems unclear, email Stripe support for clarification. Wait at least 2-4 weeks after making improvements before reapplying. Applying immediately with unchanged circumstances results in automatic rejection. Alternative processors like PayPal, Payoneer, or Paddle can serve as interim solutions while you strengthen your Stripe application.

Do I need to visit the US to set up Stripe?

No, the entire process can be completed remotely from Bangladesh or anywhere else. Here’s what you can do online: form your US LLC through formation services, obtain your EIN via IRS phone or fax, open business bank accounts with fintech solutions (Mercury, Wise, Relay), build your website and business presence, and apply to Stripe and complete verification. The only potential exception is if you choose traditional US banks that require in-person visits, but this is unnecessary given fintech alternatives. Thousands of non-resident entrepreneurs successfully operate Stripe accounts without ever visiting the United States. The key is using remote-friendly banking solutions and maintaining proper documentation.

What fees does Stripe charge for international businesses?

Stripe’s fee structure is generally consistent regardless of business location. Standard rates are 2.9% + $0.30 per successful card charge for US cards, 3.9% + $0.30 for international cards, and additional 1% for currency conversion if applicable. For subscriptions and recurring billing, the same rates apply but volume discounts may be available. Instant payouts carry 1.5% fee (optional feature). Disputes/chargebacks cost $15 per dispute. These rates are significantly lower than most alternatives—PayPal often charges 3.5%+, while traditional merchant accounts can exceed 4%. For a business processing $10,000 monthly in primarily US transactions, you’d pay approximately $320 in fees ($10,000 × 2.9% + $0.30 × ~30 transactions). The exact cost depends on average transaction size and customer geography.

Can I use Stripe with multiple businesses?

Yes, but each business should have its own Stripe account for clarity and compliance. Stripe allows multiple accounts under the same owner/email with separate accounts for each distinct business entity, different account settings and configurations per business, and individual verification and risk assessment. However, don’t create multiple accounts to circumvent restrictions or try to evade detection after suspension—this violates Stripe’s terms and results in permanent bans. If you have multiple LLCs or business ventures, set up separate Stripe accounts properly. Link them to respective bank accounts and maintain clear separation. This approach provides better financial tracking, clearer tax reporting, and appropriate risk management for each venture. Contact Stripe support if you’re unsure about your specific multi-business situation.

Conclusion: Your Path to Payment Processing Success

Getting approved for a Stripe account as a non-US resident is entirely achievable when you follow the right sequence and meet all requirements. The process requires initial setup effort—forming your US LLC, obtaining an EIN, opening a US bank account, and building legitimate business presence—but these foundational elements serve your business far beyond just Stripe access.

The key takeaways for successful Stripe approval include following the proper sequence (LLC → EIN → Bank → Website → Stripe), ensuring perfect documentation consistency across all platforms, building a professional, complete web presence before applying, choosing fintech banking solutions designed for non-residents, and being transparent about your international ownership structure.

Yes, the process takes 3-6 weeks from start to finish, and initial costs run $500-1,500 including LLC formation, banking setup, and website development. But these investments pay for themselves quickly through Stripe’s superior processing rates, features, and customer experience compared to alternatives.

Thousands of entrepreneurs from Bangladesh, India, Nepal, Nigeria, and countries worldwide are successfully processing payments through Stripe right now. The path is proven, the requirements are clear, and the benefits are substantial. Your international location doesn’t limit your business potential—it simply requires proper structure.

Ready to start accepting payments globally? Begin your journey with Rocket Wave and get expert guidance through LLC formation, banking setup, and Stripe approval. We’ve helped hundreds of non-resident entrepreneurs achieve payment processing success, and we’re here to ensure you navigate every step correctly the first time.

Don’t let payment processing be the bottleneck holding back your business growth. Start building your foundation today.

Additional Resources

Internal Links:

- US LLC Formation from Bangladesh: Complete Guide

- US Business Bank Account for Non-Residents

- EIN Application for Foreign LLC Owners

- LLC Compliance for Non-US Residents

- Rocket Wave Formation and Payment Setup Services

External Authoritative Links: